Cambodian Real Estate: A Complete Guide to Taxes on Individuals and Corporations

Author: Anna Araki / ANNA ADVISORS Co., Ltd.

Cambodia’s economy continues to grow steadily, and the government is actively promoting foreign direct investment.

Thanks to relatively low property prices and high yields, more and more foreign investors are entering the Cambodian real estate market.

At the same time, Cambodia’s overall economic environment makes it attractive as a business hub, and the country is increasingly popular as a destination for foreign companies expanding overseas.

If you choose Cambodia as an investment destination or as a base for your business, you can expect significant returns—but naturally, you may also be concerned about how taxation works.

This article explains in detail the taxes involved in Cambodian real estate investment and local business activities.

We also introduce how our firm can support you, so please read through to the end.

https://youtube.com/watch?v=nxVy6CxMneE%3Ffeature%3Doembed%26enablejsapi%3D1%26origin%3Dhttps%3A

Table of Contents

- 7 Reasons Cambodia Is Well-Suited for Economic Activity by Foreign Individuals and Corporations

- Rising GDP Growth and Land Prices

- Lower Real Estate Prices Compared with Neighboring Countries

- Young Population and Abundant Labor Force

- Ability to Hold Assets in US Dollars

- Non-Residents Can Open Local Bank Accounts

- Geographic Advantage: Neighboring Thailand and Vietnam

- Relatively Low Tax Burden and More Flexible Cash Flow

- 7 Points to Note When Foreign Individuals and Corporations Do Business in Cambodia

- Taxes Related to Cambodian Real Estate Investment

- Taxes on Business Activities in Cambodia

- No Tax Treaty Between Cambodia and Japan

- Foreign Tax Credit for Personal Income Taxes Arising in Cambodia

- How ANNA ADVISORS Supports the Economic Activities of Individuals and Corporations in Cambodia

- Summary

7 Reasons Cambodia Is Well-Suited for Economic Activity by Foreign Individuals and Corporations

Cambodia offers a favorable environment for foreign individuals and corporations to engage in economic activities.

Below, we break down seven reasons why Cambodia is so attractive as a place to invest or do business.

Rising GDP Growth and Land Prices

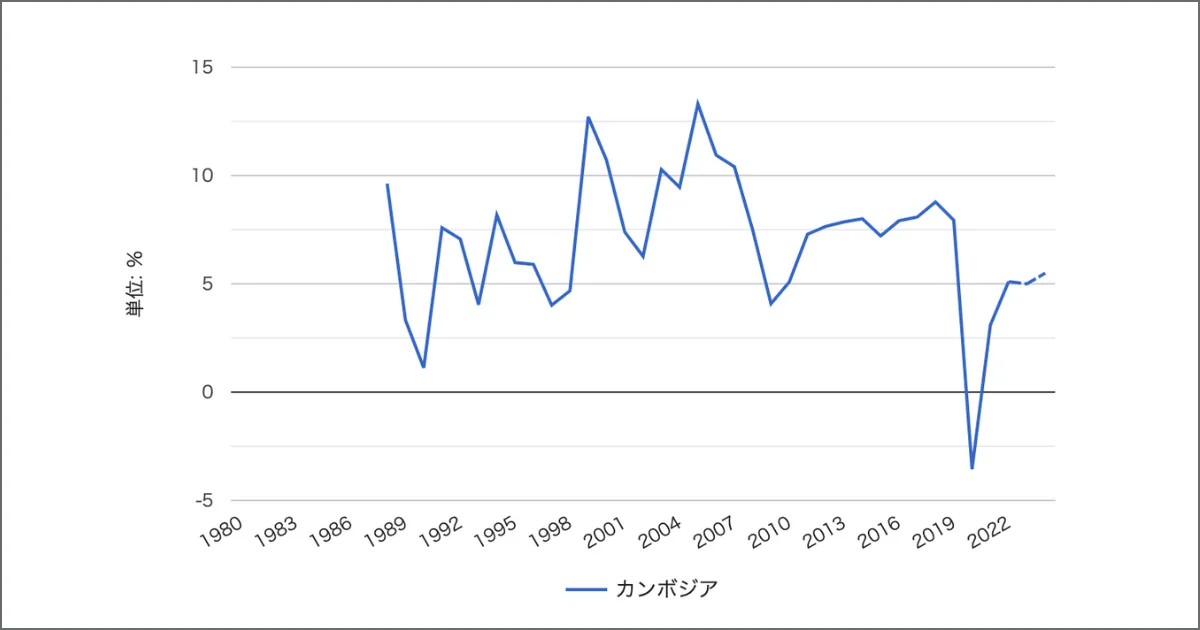

As the graph below shows, Cambodia’s GDP has continued to grow on an upward trend.

| Year | Real GDP Growth Rate (YoY) |

|---|---|

| 2019 | 7.94% |

| 2020 | -3.56% |

| 2021 | 3.09% |

| 2022 | 5.10% |

| 2023 | 5.00% |

| 2024 | 5.49% |

Source: “Cambodia Economic Growth Rate Transition” – Sekai Keizai no Netachō (World Economic Data)

Except for 2020, when COVID-19 caused a temporary downturn, GDP has consistently outperformed the previous year.

Along with strong GDP growth, land prices have also risen, creating favorable conditions for achieving returns from real estate investment.

Lower Real Estate Prices Compared with Neighboring Countries

Although land prices in Cambodia are rising, property prices are still low compared with neighboring countries.

When we compared the price of a used 1LDK (one-bedroom) condominium in Tokyo (Shinjuku), Bangkok (Thailand), and Phnom Penh, the results were:

- Phnom Penh: approx. 12.5 million yen (completed in 2023)

- Bangkok: approx. 45.8 million yen (completed in 2019)

- Tokyo: approx. 71 million yen (completed in 2023)

Because prices in Cambodia are relatively low, the barrier to entry is lower and it is easier to start investing with a smaller amount of capital.

In addition, Cambodia widely uses a “pre-build” scheme where payments are made in stages as construction progresses, which helps keep initial costs down.

Young Population and Abundant Labor Force

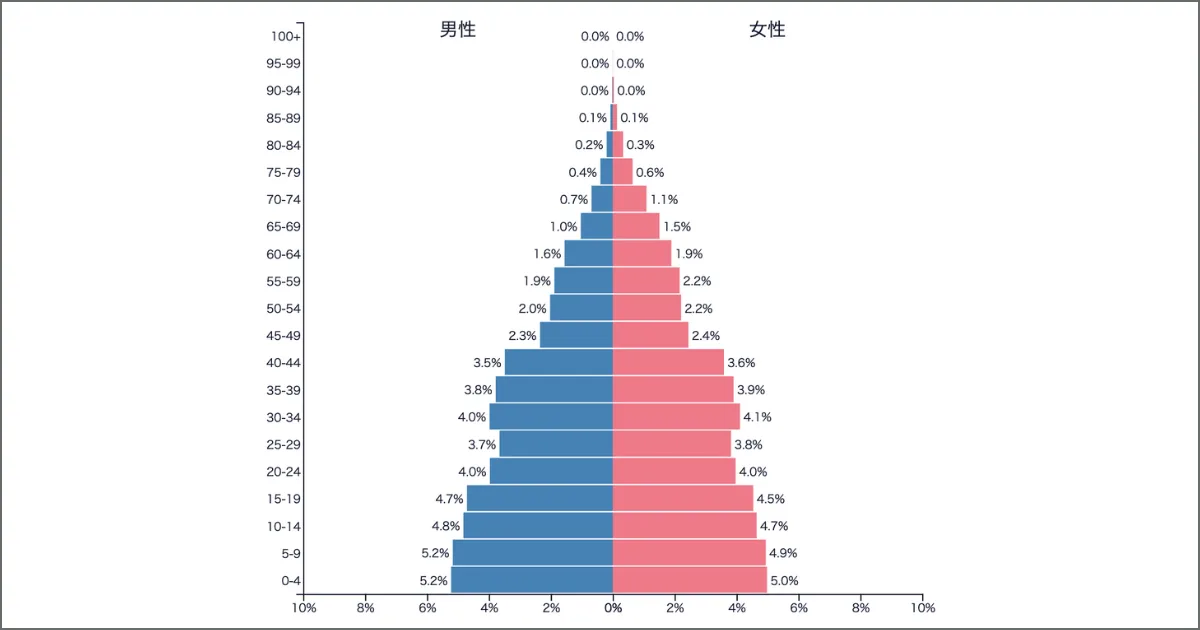

As the graph below indicates, Cambodia has a very high proportion of working-age population.

In particular, the share of young people is high, and the average age of Cambodian citizens is around 27—very young.

Because of its young population, the country can expect a large labor force for many years to come, which in turn supports GDP growth.

Ability to Hold Assets in US Dollars

US dollars circulate throughout almost the entire country and function as Cambodia’s de facto key currency.

US dollars can be used not only for daily transactions but also for real estate investments and business settlements, so foreign investors naturally build up USD-denominated assets when they operate in Cambodia.

Holding assets in USD makes it easier to hedge foreign exchange risk and respond to both yen appreciation and depreciation.

Non-Residents Can Open Local Bank Accounts

Cambodian banks offer USD-denominated accounts, and non-residents are allowed to open accounts as well.

Because the domestic economy is strong, interest rates are high—average fixed deposit rates are around 4–5%, which is very high compared to Japan.

Both for real estate investment and as a business account, Cambodian bank accounts are convenient.

At our firm, we actively recommend combining Cambodian real estate investment with local bank accounts to build assets more efficiently.

(We explain Cambodian banks in more detail in another article.)

Geographic Advantage: Neighboring Thailand and Vietnam

Cambodia lies on the Southern Economic Corridor and borders two of Southeast Asia’s most developed economies: Thailand and Vietnam.

The Southern Economic Corridor is a major arterial road that traverses the southern Indochina Peninsula and was constructed to improve the efficiency of logistics and customs procedures.

Situated between Thailand and Vietnam, Cambodia is also an important transportation hub, making it strategically valuable as a base for both business and tourism.

Relatively Low Tax Burden and More Flexible Cash Flow

Cambodia’s taxes are relatively low. For example:

- Personal income tax rate in Japan: 5–45%

- Personal income tax rate in Cambodia: 0–25%

Cambodia’s standard corporate tax rate is 20%, lower than Japan’s 23.2%.

Because income tax and corporate tax rates—two of the most significant tax burdens—are lower, higher earners and companies with larger revenues find it easier to reduce their tax burden.

One common reason for moving one’s place of residence or business overseas is the search for a lower tax environment, and from this perspective, Cambodia is one of the attractive options.

7 Points to Note When Foreign Individuals and Corporations Do Business in Cambodia

There are also some important points to be aware of when foreign individuals and corporations conduct economic activities in Cambodia.

Here we explain seven key risks and considerations.

Construction Risk of Pre-Build Properties

In pre-build schemes, buyers first pay a small down payment, then pay the remaining balance in stages as construction progresses.

While this reduces upfront costs, there is a risk that construction may be interrupted and the building never completed.

This risk is especially high for projects undertaken by smaller developers who may face cash flow problems. In Cambodia, uncompleted pre-build projects are unfortunately not uncommon.

Even if a project is not completed, there is no guarantee that payments already made will be refunded, and investors may lose their entire investment.

Because pre-build non-completion is a widely known risk in Cambodia, it is extremely important to select trustworthy developers and brokers.

Multiple Restrictions on Properties Foreigners Can Purchase

Although Cambodia promotes foreign investment in real estate, there are several restrictions on the types of properties foreigners and foreign corporations can buy:

- Foreigners may only purchase buildings completed in 2010 or later

- Foreigners may only purchase strata units in apartments/condominiums or commercial (business-use) properties

- As a general rule, foreigners cannot own land

- Foreigners may only purchase floors above the second floor

- Foreign ownership within a single building is capped at 70% of total floor area (combined with other foreign individuals and corporations)

- Foreigners may only purchase buildings located at least 30 km away from the national border

Even if a property seems ideal, it may not be eligible for purchase due to these restrictions.

When searching for a property in Cambodia, it is important to confirm with your broker in advance whether it is actually purchasable by foreigners.

Inconsistent Ways of Displaying Property Floor Area

In the Cambodian real estate industry, both net area and gross area are used when displaying a property’s floor area:

- Net area:

Total of the private interior space (living/office area) plus balcony/terrace - Gross area:

Net area plus shared spaces such as corridors, elevators, and stairwells, i.e., the entire floor area

Because different listings may display different types of area, you need to be careful. Cases have occurred in which buyers expected a large property but found the actual usable space to be much smaller than anticipated.

Some sellers also intentionally present gross area to create a misleading impression of spaciousness.

Therefore, when viewing properties, do not rely solely on floor plans and written specifications—always confirm which type of area is being used.

Multiple Types of Title Deeds

When purchasing real estate in Cambodia, it is critical to pay attention to the type of title deed.

In broad terms, there are two traditional types:

- Hard Title

- Issued at the national level

- Strong legal enforceability

- Cannot be duplicated

- Physically, a thick, formal document (booklet-style)

- Soft Title

- Issued at the local (municipality) level

- Weaker legal strength

- Multiple copies may exist

- Typically a simple single sheet of paper

Soft titles carry less legal weight and may not fully guarantee ownership, so they require caution.

In recent years, many strata titles—which resemble hard titles in their legal nature—have been issued, especially for foreign buyers.

Because the type of title and whether it has actually been issued directly affect ownership, you should never settle a property transaction without clarifying title status.

Frequent Real Estate Investment Scams

Cambodian real estate offers relatively low entry costs and high yields, which makes it very popular among foreign investors.

At the same time, some unscrupulous actors deliberately target foreign investors who are unfamiliar with local conditions and have limited visibility into on-the-ground developments.

In recent years, scam schemes have grown more sophisticated, to the point where even seasoned investors have fallen victim.

There is a widespread perception that “Japanese people are wealthy,” and Japanese investors are often seen as easy targets.

Even Japanese-run firms are sometimes involved in scams, exploiting the sense of safety created by “dealing with fellow Japanese.”

For that reason, it is important not to trust any party blindly just because they are Japanese.

(We explain overseas real estate scams in greater detail in another article.)

Vulnerable Domestic Power Supply

Cambodia’s domestic power plants alone cannot meet demand, so a large share of electricity has to be imported from Thailand and Vietnam.

Because import costs are added into the price, electricity bills can be high—especially in urban centers located far from power plants.

Moreover, the national power grid infrastructure is still underdeveloped, so power outages occur relatively frequently.

The fragility of the power supply can disrupt both business operations and day-to-day life.

Some Taxes Are Due on a Monthly Basis

Under Cambodian tax law, businesses are generally required to file and pay certain taxes on a monthly basis.

Major examples of taxes that require monthly filing include:

- Prepayment of tax on profit

- Salary tax

- Fringe benefit tax

- Value-added tax (VAT)

- Withholding tax

We explain each of these in more detail below.

Because monthly filings are required, corporate tax compliance can become complex and burdensome.

Our firm can introduce local tax accountants who can handle tax-related procedures on your behalf, helping to reduce your administrative load.

For relatively small-scale businesses, our corporate support services are available from around USD 3,000–5,000 per month (approx. 450,000–750,000 yen at 1 USD = 150 yen).

Taxes Related to Cambodian Real Estate Investment

When investing in real estate in Cambodia, several types of taxes arise.

Below, we explain real estate–related taxes, grouped by the timing of when they are incurred.

Taxes When Purchasing Real Estate

Whether you are an individual or a corporation, the main taxes incurred when purchasing real estate in Cambodia are:

| Item | Rate / Amount | Description |

|---|---|---|

| Registration Tax | 4% | 4% of the property sale price or assessed value |

| Stamp Duty | approx. 100–2,000 riel | Fee for preparing the property sale contract |

There will, of course, also be the purchase price itself.

Because many properties in Cambodia are pre-builds, the initial payment tends to be relatively low.

For example, if you purchase a property priced at 10 million yen, a simplified cost breakdown might look like this:

- Registration tax: 400,000 yen

- Stamp duty: 2,000 riel ≒ 74 yen

- Initial payment toward purchase price (pre-build): 2 million yen

- Total upfront cost: approx. 2,400,074 yen

While pre-build properties help reduce initial costs, they also carry the previously mentioned non-completion risk, so caution is required.

Taxes While Owning Real Estate

When you own real estate in Cambodia, the main taxes and costs are:

| Item | Rate / Amount | Description |

|---|---|---|

| Property Tax | 0.1% on 80% of the assessed property value | Levied annually (only for properties assessed at USD 25,000 or more) |

| Tax on Rental Income | 10% of rental income | Levied monthly when leasing the property |

| Withholding Tax | 10% or 14% | Rate depends on whether the taxpayer is a Cambodian resident or not |

| Management Fee | e.g., USD 100/month | Varies by property management company |

| Reserve for Repairs | e.g., USD 100/month | Varies by property management company |

As an example, suppose you own a property with an assessed value of 10 million yen and rent it out for 100,000 yen per month. Annual costs might look like this:

- Property tax: 8 million yen (80% of value) × 0.1% = 8,000 yen

- Tax on rental income: 10,000 yen × 12 months = 120,000 yen

- Withholding tax (non-resident): 1.2 million yen (annual rent) × 14% = 168,000 yen

- Management fee: 15,000 yen × 12 months = 180,000 yen (assuming USD 100/month at 150 yen/USD)

- Reserve for repairs: 15,000 yen × 12 months = 180,000 yen

Total annual cost: approx. 656,000 yen

Taxes and charges paid while owning the property can generally be recorded as expenses.

Taxes When Selling Real Estate

When selling real estate in Cambodia, a capital gains tax of 20% is levied on the gain.

For example, if you sell a property for 10 million yen with a 10 million yen gain (for simplicity), the capital gains tax would be 2 million yen, and your net proceeds would be 8 million yen.

However, as of 2025, Cambodia’s capital gains tax is applied only to corporate sales of real estate.

The introduction of capital gains tax on individuals has been postponed multiple times, so the future outlook remains uncertain.

Taxes on Business Activities in Cambodia

Doing business in Cambodia is subject to several different taxes.

The tax regime is more complex than that for real estate investment alone, so it is important to have a clear overview.

The taxes described below are also explained in detail on the JETRO (Japan External Trade Organization) website.

Corporate Tax: Tax on Profit and Minimum Tax

In Cambodia, all taxpayers are required in principle to register under a self-assessment regime.

Business operators must pay tax on profit at the higher of:

- 20% of annual taxable income, or

- 1% of monthly turnover

In addition to tax on profit, a separate minimum tax is also imposed.

Tax on Profit

The standard tax on profit rate is 20%, but there are special rates in certain cases:

- Qualified Investment Projects (QIP): 0% during the tax holiday period (3–9 years)

- Petroleum, natural gas, and specified natural resource development projects: 30%

- Insurance and reinsurance businesses dealing with property and risk: 5%

Tax on profit can be paid either via annual filing or by monthly filings (prepayments).

If paying monthly, 1% of monthly turnover is prepaid by the 25th of the following month.

Minimum Tax

In addition to tax on profit, companies must pay a minimum tax equal to 1% of annual gross turnover (excluding VAT and certain other taxes).

Minimum tax is imposed regardless of whether the company makes a profit or a loss and is paid via annual filing.

However, since 2017, companies that meet certain conditions—such as maintaining proper accounting records—may be exempted from minimum tax.

If your company satisfies the criteria, you may qualify for this exemption.

Value-Added Tax (VAT): Equivalent to Japan’s Consumption Tax

Cambodia’s Value-Added Tax (VAT) is similar to Japan’s consumption tax and is broken down into:

- Output VAT: VAT charged to customers on sales

- Input VAT: VAT paid to suppliers on purchases

The standard VAT rate is 10%, and businesses file VAT returns monthly.

They pay the difference between output VAT and input VAT to the General Department of Taxation.

Certain items—such as land transactions, currency supply, and educational services—are exempt from VAT.

Fringe Benefit Tax: Tax on Non-Cash Benefits

Fringe benefit tax applies to non-cash benefits provided by an employer to employees or others. Examples include:

- Use of passenger vehicles and similar items for personal purposes

- Housing or accommodation assistance (including utilities and domestic help)

- Low-interest loans and discounted sales

- Educational support (except where directly related to work)

- Insurance premiums paid for specific employees

- Excessive or unnecessary cash allowances, and social insurance or pension contributions above certain thresholds

- Entertainment or hospitality with a personal, non-business nature

Source: JETRO “Tax System – Cambodia”

The fringe benefit tax rate is 20%, and it must be filed monthly.

Withholding Tax: Tax on Services Received

Withholding tax in Cambodia also requires monthly filing.

Tax rates and applicable transactions differ for residents and non-residents.

For residents, examples of withholding tax are:

| Category | Rate |

|---|---|

| Service fees (except where valid tax invoices are issued to registered taxpayers for ≤ 50k riel) | 15% |

| Royalties | 15% |

| Interest (excluding interest paid to domestic banks and financial institutions) | 15% |

| Rental income from movable or immovable property (with certain exceptions) | 10% |

| Interest on term deposits with domestic banks | 6% |

| Interest on non-term deposits with domestic banks | 4% |

Source: JETRO “Tax System – Cambodia”

For non-residents, examples include:

| Category | Rate |

|---|---|

| Interest | 14% |

| Dividends | 14% |

| Income from services performed in Cambodia | 14% |

| Fees for management and technical services | 14% |

| Income from movable and immovable property in Cambodia | 14% |

| Royalties | 14% |

| Gains on the sale of immovable property | 14% |

| Insurance premiums related to risk | 14% |

| Gains on the sale of movable property that forms part of a permanent establishment | 14% |

| Income from business activities conducted via a permanent establishment | 14% |

Source: JETRO “Tax System – Cambodia”

Note that withholding tax applies to a wide range of services and must be filed monthly.

Salary Tax: Different Rates for Residents and Non-Residents

Salary income in Cambodia is also subject to income tax.

Tax rates differ between residents and non-residents; for non-residents, a flat 20% rate applies.

A “resident” for tax purposes is someone who, for example, has an address in Cambodia and stays in the country for at least 182 days in a tax year.

Salary includes wages, bonuses, overtime pay, and various allowances.

For residents, the progressive tax rates are:

| Monthly Salary (riel) | Approx. in USD* | Rate |

|---|---|---|

| 0 – 1,500,000 | 0 – 375 | 0% |

| 1,500,001 – 2,000,000 | 375 – 500 | 5% |

| 2,000,001 – 8,500,000 | 500 – 2,125 | 10% |

| 8,500,001 – 12,500,000 | 2,125 – 3,125 | 15% |

| 12,500,001 and above | over 3,125 | 20% |

Salary tax must also be filed monthly.

If the taxpayer has dependents—such as a non-working spouse or children above a certain age—an allowance of about USD 37.5 per dependent is deductible from taxable income.

No Tax Treaty Between Cambodia and Japan

When a company operates in two countries, it may face double taxation, being taxed twice on the same income.

To avoid this, countries conclude tax treaties that determine which country has taxing rights and what tax rates apply to specific income.

For example, if Japan and Country A have a tax treaty, Japanese companies doing business in Country A may be exempted from certain taxes (like corporate or personal income tax) in one of the two countries.

As of March 2025, Cambodia has not concluded a tax treaty with Japan.

Therefore, Japanese companies doing business in Cambodia need to be particularly mindful of potential double taxation.

Although the governments of Cambodia and Japan have discussed the possibility of a tax treaty, no agreement has yet been reached.

Foreign Tax Credit for Personal Income Taxes Arising in Cambodia

Just as companies are taxed on their business income, individuals also pay tax on income from Cambodian real estate investments.

In particular, rental income from Cambodian real estate is subject to withholding tax at:

- 10% for Cambodian residents

- 14% for Cambodian non-residents

If a Japanese national who is a non-resident of Cambodia earns rental income from Cambodian real estate, they must pay personal income tax in Cambodia.

However, they must also file an income tax return in Japan.

In Japan, foreign-source income such as Cambodian rental income is also subject to tax. Without any relief, this leads to double taxation—tax in both Cambodia and Japan on the same income.

To mitigate this, Japan allows a foreign tax credit, whereby the tax paid abroad (e.g., in Cambodia) can be credited against the Japanese tax due on the same income.

Applications for the foreign tax credit can be made via the National Tax Agency’s website.

To avoid double taxation, it is important not to overlook this procedure.

How ANNA ADVISORS Supports the Economic Activities of Individuals and Corporations in Cambodia

At ANNA ADVISORS, we actively support both individuals and corporations with Cambodian real estate investment, local market entry, and business start-up.

We have an office in Phnom Penh, enabling us to respond quickly to clients on the ground.

Below is an overview of our main services.

For Individuals: Long-Term Support for Asset Building via Real Estate Investment and Bank Accounts

For individual clients, we focus on supporting real estate investment and the opening of Cambodian bank accounts.

In Cambodia’s fast-growing economy, many properties offer expected yields of around 10%.

By combining high-yield properties with high-interest Cambodian bank accounts, investors can build assets even more efficiently.

We view property purchase and bank account opening as merely the starting point.

Our core philosophy is to stand alongside clients over the long term, emphasizing consistent, ongoing support for asset building rather than one-off transactions.

We regularly hold investment seminars in Japan and host local tours in Cambodia that combine property viewings and bank account opening.

We also handle property purchases and account opening online, so feel free to contact us from anywhere.

For Corporations: Total Coordination for Market Entry and Company Establishment in Cambodia

Our representative, Ms. Araki, established real estate and financial businesses in Cambodia and has been operating in both Japan and Cambodia for over a decade.

Drawing on this experience, we support companies in entering the Cambodian market or starting businesses locally.

In addition to brokering office and residential properties, we can arrange office equipment, coordinate interior fit-outs, and provide comprehensive support for local operations.

Because company establishment procedures in Cambodia are conducted primarily in English, they can be difficult to navigate alone.

We can introduce local lawyers to handle and support these procedures on your behalf.

Cambodian tax rules are also complex: there are many different taxes, and monthly filings are required.

To address this, we can introduce tax accountants who support accounting and tax compliance.

For relatively small-scale companies, our comprehensive support packages—including introductions to lawyers and tax accountants—are available from about USD 3,000–5,000 (approx. 450,000–750,000 yen at 1 USD = 150 yen).

(We also explain Cambodian company establishment in more detail in another article.)

Summary

When individuals and corporations invest or conduct business in Cambodia, various taxes are levied, including personal income tax and corporate tax.

Although Cambodian tax rates are generally lower than Japan’s, making it easier to conduct economic activity, non-residents are also subject to taxation and must be careful.

Some taxes must be filed monthly, and Cambodia’s tax system and rates differ from those in Japan, which can be confusing at first.

As part of our overall support, we can introduce tax accountants who are familiar with Cambodian tax law.

At ANNA ADVISORS, we support the economic activities of both individuals and corporations in Cambodia, including the introduction of tax specialists.

If you wish to resolve your concerns about tax and focus on growing your economic activities in Cambodia, please feel free to contact us.