Cambodian Real Estate: Is There a Bubble? A Thorough Guide to Key Points for Sound Investment

Author: Anna Araki / Anna Advisors Inc.

The Cambodian real estate market is on an expansionary trend and is attracting growing attention from foreign investors thanks to its many advantages.

At the same time, some observers say the market is in a “bubble,” and there are certainly voices urging caution about entering it too lightly.

In this article, we explain the current state of the Cambodian real estate market, take a close look at its disadvantages and risks, and also introduce some of our recommended properties.

If you are considering investing in Cambodia, we invite you to read through to the end.

Table of Contents

- Reasons Why Cambodian Real Estate Is Said to Be in a Bubble (5 Points)

- GDP Growth Is Trending Upward and Land Prices Are Rising

- Land Prices Are Rising but Real Estate Prices Are Still Cheaper Than in Neighboring Countries

- A Young Population Is Driving Growing Housing Demand

- Active Participation by Foreign Investors

- Real Estate Transactions Can Be Conducted in US Dollars

- Three Key Benefits of Investing in Cambodian Real Estate

- Seven Risks and Drawbacks of Investing in Cambodian Real Estate

- Risk of Non-Completion or Delayed Completion of Pre-Built Properties

- Insufficient Legal Framework Around Real Estate

- Various Restrictions on Property Purchases by Foreigners

- Mixed Use of Gross and Net Floor Area

- Wide Variation in the Quality of Real Estate Agents

- Exaggerated Sales Talk by Some Agents

- A Social Structure in Which Bribery Is Widespread

- Five Tips to Avoid Failure in Cambodian Real Estate Investment

- Taxes Commonly Incurred in Cambodian Real Estate Investment

- Why Properties Around Phnom Penh Are Recommended

- Three Recommended Cambodian Properties

- Why It’s Best to Use Surplus Funds for Cambodian Real Estate Investment

- Conclusion

Reasons Why Cambodian Real Estate Is Said to Be in a Bubble (5 Points)

“Bubble” is short for “bubble economy” and refers to a situation in which speculation causes real estate and stock prices to balloon like a bubble, rising rapidly to levels that are completely detached from fundamentals.

Japan’s own bubble collapse is still relatively recent in memory and dealt severe damage to the Japanese economy.

There are also concerns about a real estate bubble in Cambodia. Below we explain five key factors that are considered to be driving bubble-like conditions.

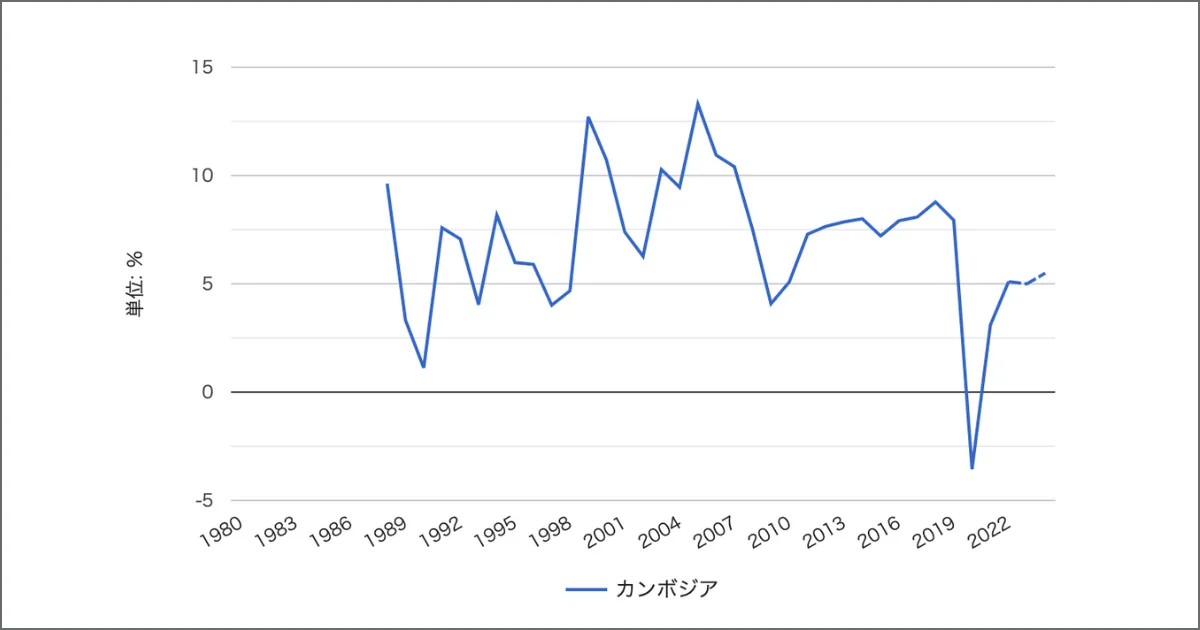

GDP Growth Is Trending Upward and Land Prices Are Rising

Cambodia’s GDP has been growing year by year, and the domestic economy is performing strongly. Recent GDP growth rates are as follows:

| Year | GDP Growth Rate (YoY) |

|---|---|

| 2019 | 7.94% |

| 2020 | -3.56% |

| 2021 | 3.09% |

| 2022 | 5.10% |

| 2023 | 5.00% |

| 2024 | 5.49% |

Source: World Economic Data “Cambodia – Economic Growth Rate Trends”Z

In 2020, the growth rate dipped below the previous year due to the COVID-19 pandemic, but in all other years Cambodia’s GDP has grown faster than the year before.

Along with this strong economic performance, real estate prices have also risen. In particular, property prices in Phnom Penh are now roughly two to three times higher than they were 10 years ago.

On the one hand, surging property prices are seen as a major investment opportunity. On the other, the rapid rise in land values is also a cause for concern.

Land Prices Are Rising but Real Estate Prices Are Still Cheaper Than in Neighboring Countries

Although Cambodian property prices are higher than before, the overall price level is still relatively low compared with neighboring countries.

For example, when comparing the price of a 1LDK (one-bedroom + living/dining area) resale unit in Tokyo (Shinjuku), Bangkok (Thailand), and Phnom Penh, we see roughly the following:

- Phnom Penh: approx. JPY 12.5 million (completed 2023)

- Bangkok: approx. JPY 45.8 million (completed 2019)

- Tokyo: approx. JPY 71 million (completed 2023)

In Cambodia, even high-end condominiums can often be purchased in the JPY 10-million range if they are resale properties.

Because prices are relatively low, it is easier to buy for investment purposes. However, there are concerns that the number of units sold for investment is diverging from real end-user demand.

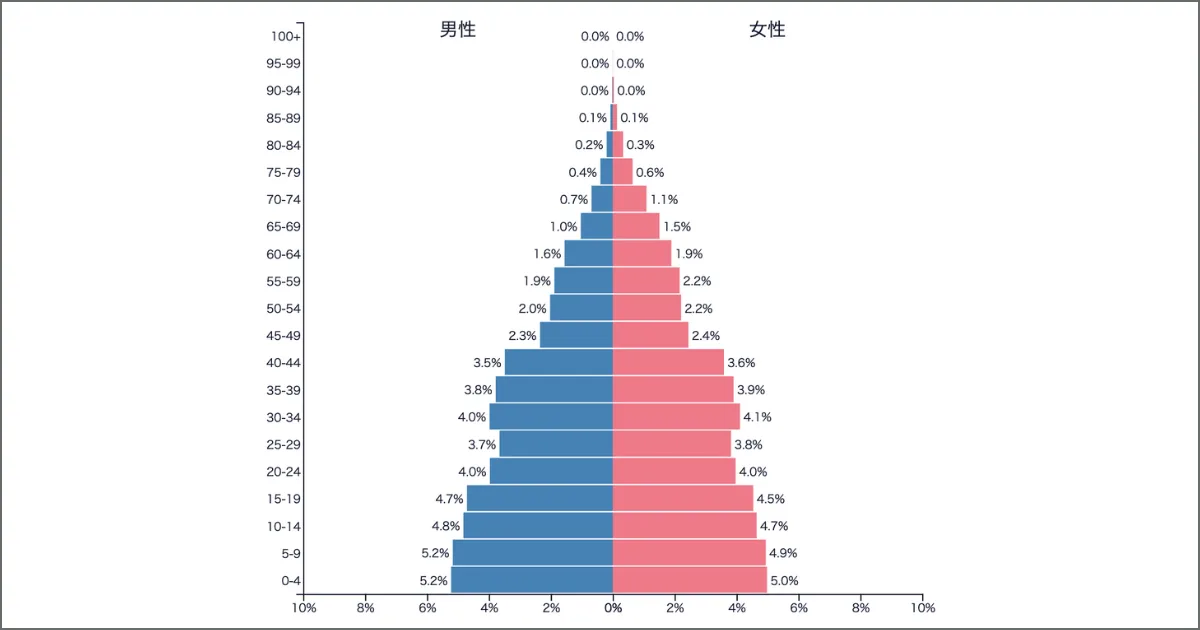

A Young Population Is Driving Growing Housing Demand

Cambodia’s population structure is characterized by a very large proportion of young people, as illustrated by its population pyramid.

Source: PopulationPyramid.net – “World Population Pyramid: Cambodia 2024”

The national average age is only 27, and housing demand—especially as people get married and start families—is expected to continue to increase.

As the country’s average income rises, housing demand is expected to expand further.

While this growing housing demand fuels an active market, there is also a risk that if supply becomes saturated, prices could fall sharply.

Active Participation by Foreign Investors

Because Cambodian properties are relatively inexpensive and offer high yields, they provide many advantages for foreign investors as well.

Chinese investors in particular are very active, reflecting the close economic relationship between China and Cambodia.

The Cambodian government is aggressively pursuing policies to attract foreign capital and has created an environment that makes it easy for foreigners to invest.

Given this backdrop, foreign capital is expected to play a major role in keeping the market active going forward.

At the same time, there are concerns that excessive reliance on Chinese money and a rise in investment-oriented properties detached from real demand may be helping to inflate a bubble.

Real Estate Transactions Can Be Conducted in US Dollars

In most parts of Cambodia, US dollars are widely used and function as a de facto key currency.

The US dollar is also the central currency in global foreign-exchange markets.

Because US dollars circulate so broadly in Cambodia, the country’s economic base is tightly linked to major global FX markets.

A dollar-based economic structure can be advantageous from a foreign-exchange perspective, but it also means Cambodia is more vulnerable to fluctuations in the US economy.

Three Key Benefits of Investing in Cambodian Real Estate

Although some say the Cambodian market is in a bubble, the environment is also favorable for investment in many respects.

Moreover, Cambodian real estate offers several distinct advantages.

Below we introduce three of the main benefits.

Properties With Guaranteed Yields

In Cambodia, it is quite common to find properties that come with a guaranteed yield.

For such properties, the yield will not fall below the guaranteed rate, which significantly reduces the risk of losses.

There are also properties that guarantee a buyback price, which can help lock in capital gains.

Guaranteed products are particularly suitable for investors who want to keep risk as low as possible.

That said, caution is required when smaller or financially unstable developers use guaranteed yields as a sales hook.

- If the developer goes bankrupt, those guarantees may effectively become worthless.

- Where the developer has little track record, the property might even be a kind of “bait” product.

Always check the developer’s track record and reputation when considering such offers.

Non-Residents Can Open Local Bank Accounts

In Cambodia, even non-residents can open local bank accounts.

Term-deposit interest rates at Cambodian banks average around 4–5%, which is very high.

By combining high rental yields from real estate with high deposit interest, you can achieve very efficient asset management.

Real estate investment generally requires a large upfront outlay, but most Cambodian bank accounts can be opened with an initial deposit of only USD 100–200.

Viewed purely as a way to start investing, opening a bank account is a much lower barrier than buying a property.

Our firm recommends combining Cambodian real estate with local bank deposits as a set investment strategy, but we also support bank-account opening only if that is what you prefer.

No Limit on International Bank Transfers

Because the US dollar functions as the de facto key currency in Cambodia, bank accounts can be denominated in USD.

One major advantage of Cambodian banks is that there are effectively no limits on overseas remittances.

This makes it possible to move funds quickly and flexibly.

Smooth transfers between accounts greatly enhance the convenience of managing your assets.

However, since international transfers generally incur fees, it is best to avoid using them excessively.

Seven Risks and Drawbacks of Investing in Cambodian Real Estate

In addition to concerns about a bubble, Cambodian real estate investment also involves a number of specific risks and disadvantages.

Below we outline the key ones. With the right knowledge and precautions, many of these risks can be mitigated.

Risk of Non-Completion or Delayed Completion of Pre-Built Properties

In Cambodia, many projects are sold on a “pre-build” basis.

Under the pre-build system, the buyer first pays a relatively small down payment, then pays the remaining purchase price in stages as construction progresses.

If the developer runs into financial difficulties, construction may be suspended—and in principle, the funds you have already invested will not be refunded.

Even when projects do get completed, it is common for completion to be significantly delayed compared with the original schedule.

These problems are most frequent with small or newly established developers.

By focusing on projects developed by large or Japanese developers with a proven track record, you can reduce the risk of non-completion or serious delays.

Insufficient Legal Framework Around Real Estate

Compared with developed countries, the Cambodian real estate market is still immature, and the legal framework is far from complete.

For example:

- The introduction of capital gains tax for individuals has been postponed multiple times.

- This makes long-term tax planning and investment planning more difficult.

In Cambodia, rules can change abruptly due to legal amendments, so investors need to be particularly aware of this legal and regulatory risk.

Under the current Hun Manet administration, there are signs that the government is working to strengthen and systematize real-estate–related laws.

Various Restrictions on Property Purchases by Foreigners

While the Cambodian government actively encourages foreign real estate investment, it also imposes a number of restrictions on what foreign investors can buy, including:

- Foreigners can only own individual condominium/apartment units and commercial properties (individual foreign land ownership is not allowed).

- Foreigners may only buy buildings completed in 2010 or later.

- Foreigners may only buy units on the second floor or above.

- In any one building, foreigners in total (including foreign corporations) may own no more than 70% of the total floor area.

- Foreigners may only buy buildings located at least 30 km from the national border.

Even if a property seems ideal, you may not be able to purchase it if it fails to meet these conditions.

It is therefore important to always check whether a property falls within or outside these restrictions when searching for investments.

Although individual foreigners cannot own land in Cambodia, there are cases where land can be owned through a local corporation.

For more details on land ownership by foreigners in Cambodia, please refer to our dedicated article on that topic.

Mixed Use of Gross and Net Floor Area

When describing property size in Cambodia, either gross floor area or net floor area may be used. The difference is as follows:

- Gross floor area: total area of the entire floor, including corridors, stairways, elevators, etc.

- Net floor area: the usable area of the unit, including balconies and verandas.

In Japan, property size is almost always expressed using net floor area.

In Cambodia, however, the distinction between gross and net is often unclear, and both methods of measurement may be used interchangeably.

There are cases where only the gross floor area is disclosed, resulting in situations where the actual usable space is much smaller than the buyer expected.

When searching for properties in Cambodia, always:

Visit and inspect the property in person whenever possible.

Confirm which measurement method is being used; and

Wide Variation in the Quality of Real Estate Agents

Because the Cambodian real estate market is still developing, the quality of real estate agents is extremely mixed.

Unfortunately, there are some fraudulent or unethical agents who target foreigners unfamiliar with local conditions.

There are also individual brokers who boast things like “I am close to senior government officials,” but in most cases such claims should be treated as false until proven otherwise.

Management companies also tend not to provide the same level of service that is common in Japan, and building cleaning and maintenance may be inadequate.

Of course, there are many high-quality agencies as well. The key is to assess and select trustworthy partners.

Exaggerated Sales Talk by Some Agents

In some cases, Japanese real estate agencies selling Cambodian properties make exaggerated claims such as:

“We are the only company in Japan with exclusive sales rights for this property.”

These claims can create the false impression that a single agency holds exclusive rights to sell the entire building. In reality, these claims are usually misleading.

Often, the agency has simply paid the developer for temporary exclusive rights over a certain block of units or for a limited period.

Rather than taking one company’s promotional claims at face value, always double-check with multiple agencieswhether they handle a particular property.

When our firm holds exclusive sales rights for certain units or floors, we clearly state the scope of those rights on our website.

A Social Structure in Which Bribery Is Widespread

Cambodia is not unique in this respect, but in many emerging countries public institutions do not operate fully as they should, and bribery remains widespread.

In Transparency International’s 2023 Corruption Perceptions Index, Cambodia ranked 158th out of 180 countries surveyed, placing it among the most corrupt in Southeast Asia.

In Cambodia, it is almost routine for officials to demand bribes when issuing property titles.

Foreigners, in particular, are frequently targeted for such payments, and it is common for civil servants and police officers to treat bribe requests as a matter of course.

The Hun Manet administration has expressed concern about the prevalence of bribery, and appears to be seeking to stamp it out through legal reform and tougher penalties.

Five Tips to Avoid Failure in Cambodian Real Estate Investment

Because Cambodian real estate comes with its own distinctive risks and disadvantages, it is important to take steps in advance to minimize the chance of failure.

Below are five key points to keep in mind.

Gather Information via Social Media and Other Sources

Compared with domestic real estate, information on Cambodian properties can be relatively scarce.

For that reason, we recommend collecting information through social media, blogs, and other online sources.

Individual blogs and social media accounts often provide more candid commentary about the realities of investing than promotional material from agencies.

A resource we personally recommend is the “Cambodia Real Estate Blog” .

It is updated daily by Shunji Tani, CEO of TANICHU ASETTMENT CO., LTD., a leading figure in the local industry.

The blog covers a wide range of topics, including:

- Analysis of the current state of the Cambodian market

- Updates on the company’s own projects and development progress

- Recommendations for local restaurants and other lifestyle information

It is also notable for its frank and sometimes critical commentary on problematic actors in the local market.

For more recommended blogs related to Cambodian real estate, please see our separate article on that subject.

Visit the Country and Inspect Properties On-Site

In real estate investment, physically visiting properties and their surroundings is extremely important.

The atmosphere within and around the site—something you can only sense on the ground—provides invaluable information.

By inspecting properties in person, you can gather far more information than from floor plans and photos alone, allowing you to make better-informed decisions.

While you can arrange property viewings directly with local agents, we also recommend using inspection tours run by reputable intermediaries.

- Such tours typically provide dedicated vehicles, enabling you to visit multiple properties efficiently.

- They can also be a great opportunity to build your network with fellow participants.

Our firm regularly hosts inspection tours of Cambodian properties and can also organize small-group private tours.

Optional side trips—such as visits to Angkor Wat—are also available on request.

Ensure There Are No Omissions in Registration Procedures

In any real estate market, proper registration of your ownership rights is essential for preventing disputes.

In Cambodia, title documents are known as “titles”, and broadly fall into two categories:

- Hard title: equivalent to a formal ownership certificate in Japan, issued by national authorities. It is physically sturdy and carries strong legal weight.

- Soft title: issued under the name of the local commune chief, printed on a single sheet of paper and not as reliable or powerful as a hard title.

For foreigners, a form of title known as a “strata title”, which has characteristics similar to a hard title, is widely used for condominium units.

When purchasing a property, it is crucial to ensure that you obtain the appropriate title and complete all related registration procedures without omissions.

Plan Your Exit Strategy in Advance

Having a clear exit strategy from the outset is crucial for increasing the likelihood of success in real estate investment.

Before purchasing a property, it is helpful to think through questions such as:

- Are you aiming for a short-term resale or long-term holding?

- Do you want to sell once you have recovered a certain amount of cash, or do you intend to keep the asset as a long-term holding?

- Do you prioritize income gains (rental income) or capital gains (resale profit)?

Your approach to management will differ depending on the answers.

We also recommend asking your real estate agent to simulate different scenarios for your asset management.

Our firm specializes in supporting clients’ asset-building and can propose properties that fit your individual investment plan.

Secure a Trustworthy Real Estate Agent

As mentioned earlier, the quality of real estate agents in Cambodia varies widely, and there are fraudulent actors in the market.

There are also sophisticated scams that specifically target foreign investors who have difficulty keeping an eye on what is happening locally.

Choosing the right real estate agent is therefore crucial for success in Cambodian property investment.

We recommend selecting a Japanese agency with:

- A long track record

- Extensive experience

- The ability to communicate clearly without misunderstandings

Our firm has been operating locally for over 10 years, and we have handled a large number of rental and sales transactions.

We currently maintain offices in both Tokyo and Phnom Penh, with Japanese staff permanently based at our Phnom Penh office.

We hold a Japanese real estate brokerage license and also maintain a local business license in Cambodia, operating under approvals from the relevant government agencies.

Taxes Commonly Incurred in Cambodian Real Estate Investment

In Cambodian real estate investment, taxes are incurred both at the time of purchase and during the ownership/operation phase.

The main taxes and fees are as follows:

| Name | Timing | Tax Rate / Explanation |

|---|---|---|

| Property Transfer Tax | At purchase | 4% of either the purchase price or the assessed value, whichever is higher |

| Stamp Duty | At purchase | 100–2,000 riel (approx. JPY 4–80 at 1 riel = JPY 0.04) |

| Rental Management Fee | Monthly | Fee paid to the management company (approx. USD 100/month ≈ JPY 15,000 at USD 1 = JPY 150) |

| Building Management Fee | Monthly | Building maintenance and reserve fees (approx. USD 100/month ≈ JPY 15,000 at USD 1 = JPY 150) |

| Withholding Tax | Monthly | 10% of rental income for residents; 14% for non-residents |

| Rental Income Tax | Monthly or annually | 10% of gross rental income for investment properties |

| Property Tax | Annually | Applies to properties worth USD 25,000 or more; 0.1% of 80% of the assessed value |

| Capital Gains Tax | At sale | 20% of capital gains; currently individuals are exempt, but capital gains tax on individuals is scheduled after Dec. 31, 2025 |

Cambodian real estate typically offers projected yields of around 5–10%, but these taxes and fees must be factored into your cash-flow planning.

Capital gains tax on individuals was originally scheduled for introduction in 2025, but implementation has been postponed, and the timing of its introduction is currently on hold.

Why Properties Around Phnom Penh Are Recommended

In Cambodia, the number of high-end condominiums is increasing, particularly in Phnom Penh, where many foreign high-net-worth individuals and wealthy locals are moving in.

Many more high-grade condominiums are scheduled for completion in Phnom Penh in the coming years, making it easier to:

- Secure tenants; and

- Achieve high returns on your investment.

By contrast, many rural properties still suffer from unclear ownership histories due to the disruption caused by past civil conflicts, leading to high defect and title risk.

For that reason, we generally do not recommend investing in rural properties.

Our firm carefully selects properties around Phnom Penh and focuses on those that are suitable even for first-time investors.

For more information on recommended areas for Cambodian property investment, please see our detailed article on that topic.

Three Recommended Cambodian Properties

There are many attractive investment properties in and around Phnom Penh.

Below are three local properties that we handle and particularly recommend.

J-Tower 3 | Cambodia’s Highest-Grade Condominium Developed by a Japanese Company

J-Tower 3 is the third building in the popular J-Tower condominium series.

Scheduled for completion in October 2028, it is positioned as one of the most luxurious condominium projects in Cambodia.

The property is located in the prime BKK1 district and will rise 77 floors above ground (approx. 320 meters tall).

It is a high-end, family-oriented condominium targeted at wealthy residents, and is planned to include a rooftop pool, sky bar, fitness gym, sauna, and other facilities.

The developer is TANICHU ASETTMENT CO., LTD., headed by Shunji Tani.

Given that two previous J-Tower projects have already been successfully completed, the likelihood that J-Tower 3 will be completed as scheduled is extremely high.

Despite being a massive project that incorporates cutting-edge Japanese developer know-how, the total number of units has been intentionally kept low at 360 in order to ensure generous living spaces.

With a projected yield of 12% and prices starting from USD 1,850 per square meter, the property offers exceptional cost performance and is one of our top recommendations.

Le Condé BKK1 | Prime-Location Condominium With 5-Year Rental Guarantee

Le Condé BKK1 is a high-end condominium located in one of Cambodia’s most prestigious residential areas.

It is a 43-story high-rise with a total of 1,080 units.

Despite being effectively brand new (completed in August 2024), some units can be purchased from the equivalent of around JPY 10 million, making the pricing highly attractive.

The building features a pool, gym, and sauna, and comes equipped with smart home appliances to enhance everyday convenience.

Combining cutting-edge Chinese developer technology with high-quality maintenance by a Japanese management company, Le Condé BKK1 offers both performance and reliability.

On top of that, the units we handle come with a 5-year rental guarantee, which is an exceptional benefit.

Vue Aston | Riverside Condominium With Hotel Floors

Vue Aston is a hotel condominium located in the Chbar Ampov district on the outskirts of Phnom Penh, boasting panoramic views over the Mekong and Bassac rivers.

Completed in August 2024, the building rises 38 floors and contains 895 units in total.

The property offers a pool, lounges, a rooftop running track, and five different gardens.

Its views and architectural beauty are among the best in the area.

With a projected 10-year yield of 8.5%, Vue Aston offers strong returns, and there is also an option for a buyback guarantee at the original purchase price.

Hotel floors are scheduled to open in spring 2025, and our firm holds exclusive rights for those hotel units.

Why It’s Best to Use Surplus Funds for Cambodian Real Estate Investment

Japan experienced its own bubble economy in the 1980s, characterized by an unprecedented boom and soaring land and stock prices.

At the time:

- Many investors took on positions far beyond their true repayment capacity; and

- Some real estate firms engaged in aggressive land aggregation (“jōage”) that became a social problem.

The severe downturn that followed the bubble burst was closely tied to excessive optimism and speculative fervor.

There are similar concerns around the current Cambodian market, which some argue is in a bubble.

It is therefore vital to calmly monitor market trends and consider in advance how you would respond if conditions turn negative.

Rather than gambling on a quick windfall, we recommend using surplus funds for investment and practicing conservative, sustainable asset management.

That mindset makes it easier to make sober, well-balanced decisions.

Our firm recommends diversified investment strategies designed to minimize risk and views Cambodian real estate as one option within a broader portfolio.

We offer personalized proposals tailored to each client’s financial situation.

If you are unsure of the best way to structure your own asset management strategy, please feel free to consult us.

Conclusion

There are certainly voices warning that Cambodia’s real estate market is in a bubble, but it is also true that the overall market environment is favorable.

If you avoid unrealistic expectations and keep a cool head while watching the market, there is ample potential to achieve strong results.

The key is to:

- Weigh the advantages, disadvantages, and risks in a balanced way; and

- Focus on conservative asset management using surplus funds.

Our firm specializes in supporting clients’ asset management and can propose investment plans that fit your specific circumstances.

We also actively organize inspection tours that combine property visits with local bank-account opening.

If you are considering investing in Cambodian real estate, we would be delighted to assist you.