Cambodia Offers a Wide Range of Office Options: A Complete Guide to Market Prices and Recommended Properties

Author: Anna Araki / ANNA ADVISORS Co., Ltd.

Cambodia’s GDP growth rate has been steadily rising, drawing strong interest from investors and attracting growing numbers of foreign companies.

More than 1,200 Japanese companies have already entered the Cambodian market, and firms from around the world continue to establish a presence there.

Choosing the right office property as your business base is a crucial decision.

In this article, we explain in detail the types of office spaces you can lease in Cambodia, typical price ranges, and other key points.

We also introduce recommended office properties, so we hope you’ll stay with us to the end.

Table of Contents

- Cambodia Is a Popular Destination for Foreign Companies

- 5 Reasons Foreign Companies Find It Easy to Do Business in Cambodia

- 3 Key Points to Note When Foreign Companies Do Business in Cambodia

- For Foreign Companies in Cambodia, a Private Limited Liability Company Is Recommended

- It is common for foreign companies to establish a local subsidiary

- Approximate Initial Costs for Foreign Companies Establishing a Company in Cambodia

- Steps for Foreign Companies to Establish a Company in Cambodia

- Decide on a trade name to be used locally

- Consider office, residential, and other properties

- Prepare the documents required for company registration

- Obtain the trade name from the Ministry of Commerce

- Register for tax with the General Department of Taxation (GDT)

- Receive the certificate of incorporation and tax documents

- Register your corporate bank account with the GDT

- Complete employment-related procedures with the Ministry of Labour and Vocational Training

- Hire employees as needed

- Licenses May Be Required Depending on the Business Type

- The Three Main Types of Office Properties in Cambodia

- Market Price Ranges for Office Properties in Cambodia by Purpose

- Phnom Penh Is the Recommended Location for Office Properties

- 5 Recommended Commercial Properties in Phnom Penh

- Flatiron: hotel-attached offices in the financial district

- Exchange Square: retail-attached offices with state-of-the-art systems

- Vattanac Capital Tower: a mixed-use office building that is also a popular tourist spot

- Sathapana Bank Tower: office building attached to a major bank closely tied to Japanese business

- Vue Aston: condo with co-working space suitable for sole proprietors

- When Entering Cambodia, It’s Best to Open Both Corporate and Personal Bank Accounts

- ANNA ADVISORS Provides Total Support for Corporate Entry into Cambodia

- Summary

Cambodia Is a Popular Destination for Foreign Companies

Cambodia’s economy is growing rapidly, and domestic business activity is becoming increasingly vibrant.

Many foreign companies are attracted by Cambodia’s robust economic performance and are choosing Cambodia as a base for their overseas operations.

According to a JETRO survey, as of 2022 there were 1,290 Japanese companies operating in Cambodia, broken down as follows:

- Service industry: 614 companies (47.6%)

- Trading: 250 companies (19.4%)

- Construction and real estate: 152 companies (11.8%)

- Manufacturing: 90 companies (7.0%)

Source: JETRO Business Brief “Nearly 1,300 Japanese companies continue operations; service industry accounts for the largest share (Cambodia), May 11, 2022”

Major companies such as AEON and Toyota have also entered Cambodia, and the arrival of capital-rich foreign firms continues to energize the business environment.

The number of entrepreneurs starting new businesses in Cambodia is also rising, and the environment for fostering entrepreneurs is steadily improving.

For more details on starting a business in Cambodia, please see our related article.

5 Reasons Foreign Companies Find It Easy to Do Business in Cambodia

There are several reasons why foreign companies find Cambodia a favorable environment for business.

Below, we highlight five key advantages that make Cambodia well-suited for corporate activity.

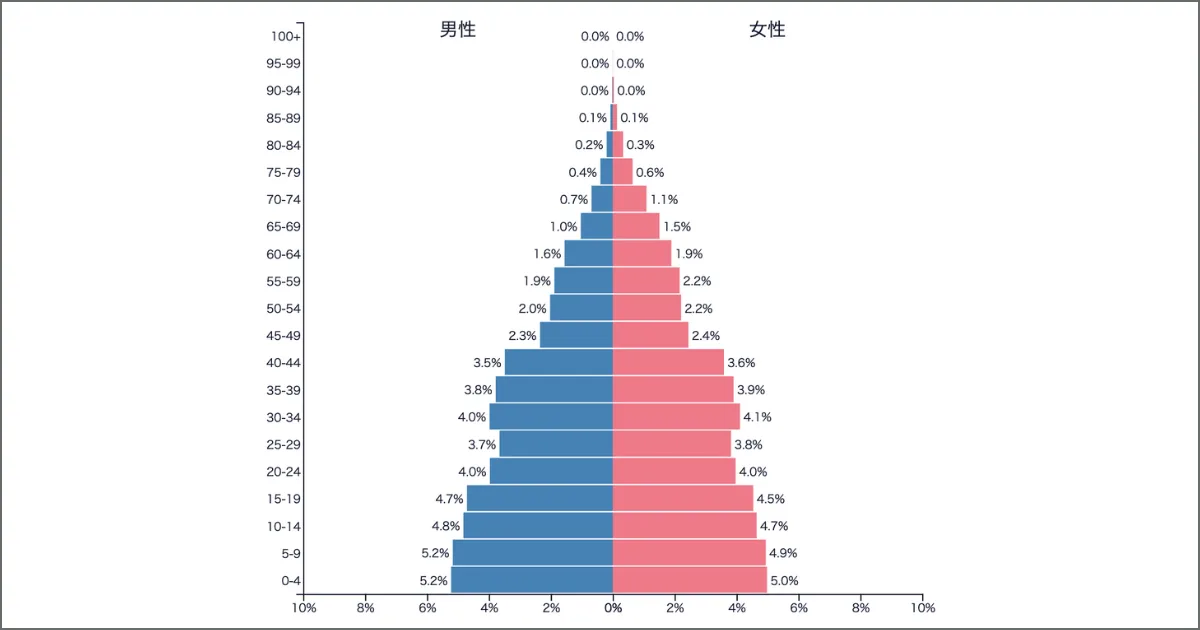

A Young Population Provides Abundant Labor Over the Long Term

As the chart below shows, Cambodia’s population structure is dominated by a large working-age population (15–64 years old).

In particular, the proportion of young people is high, making it relatively easy to secure a large labor force over the long term.

Although wages have been rising in recent years, they are still lower than those in neighboring countries, which is another major attraction for employers.

The Government Is Actively Encouraging Foreign Investment

Under Prime Minister Hun Manet, the Cambodian government is implementing policies to actively attract foreign capital.

Cambodia has established multiple Special Economic Zones (SEZs), where companies located within these zones enjoy various incentives, including reductions and exemptions on certain taxes.

Plans for dedicated economic zones with neighboring countries are also underway. For example, between late 2023 and early 2024, Cambodia and Japan announced a joint economic zone concept under former Prime Minister Fumio Kishida.

These outward-looking policies and tax incentives are powerful drivers encouraging foreign companies to enter the Cambodian market.

A Geographically Advantageous Location Along the Southern Economic Corridor

Cambodia is located along the Southern Economic Corridor, giving it significant geographic advantages for business.

The Southern Economic Corridor is a major international highway network that links the southern part of the Indochina Peninsula across borders, enabling smooth access to neighboring countries such as Thailand and Vietnam.

Thailand and Vietnam both have strong economies and are high-demand destinations as business hubs.

Situated between these two markets, Cambodia is highly regarded from a geographic standpoint as a strategic base for business operations.

Relatively Low Costs for Company Incorporation

As we will discuss in detail later, the cost of incorporating a company in Cambodia is relatively low—approximately 170,000–220,000 yen (assuming 1 USD = 150 yen).

Low upfront costs allow companies to establish a corporation with a smaller initial capital outlay and preserve more funds for post-incorporation operations.

In addition, foreign companies can set the capital contribution ratio at 100% foreign ownership when establishing a company in Cambodia.

Because domestic capital participation is not required, foreign investors can structure their capital freely and establish a company smoothly without being constrained by local ownership requirements.

Low Tax Burden Reduces Pressure on Business Operations

In principle, the corporate income tax rate for companies in Cambodia is 20%, lower than Japan’s 23.2%.

Personal income tax rates are also lower: whereas Japan’s range is 5–45%, Cambodia’s is 0–20%.

The higher the company’s revenues or the individual’s income, the greater the benefit of these lower tax rates.

Compared to Japan, Cambodia’s relatively low tax burden is a common reason cited for overseas migration and overseas expansion, making Cambodia a strong candidate destination from a tax-planning perspective.

Key Points to Note When Foreign Companies Do Business in Cambodia

There are also a number of points that foreign companies need to keep in mind when doing business in Cambodia.

Here, we highlight three key considerations for foreign businesses when entering the Cambodian market.

Electricity Supply Is Less Stable Than in Neighboring Countries

Compared with its neighbors, Cambodia’s infrastructure is still developing, and in particular, its electricity supply is often cited as fragile.

Because domestic power generation alone cannot meet the country’s demand, Cambodia relies heavily on electricity imports from Thailand and Vietnam.

Import costs are built into electricity prices, which tend to be high—especially in urban areas farther from power plants.

In addition, the power transmission network is not fully developed, so power outages occur relatively frequently.

These weaknesses in the power supply can cause disruptions both to business operations and to daily life.

There Are Restrictions on Properties That Foreign Companies Can Purchase

While Cambodia encourages foreign economic activity, there are restrictions on the types of real estate that foreigners can purchase, including:

- Foreigners may only purchase buildings completed in 2010 or later

- Foreigners may only purchase units in apartments/condominiums or commercial properties

- Foreigners may only purchase floors from the second floor and above

- The total floor area owned by foreigners in a single building must not exceed 70% (combined with other foreign individuals and entities)

- Foreigners may only purchase buildings located at least 30 km from the national border

Even if a property matches your needs, you may not be able to buy it if it falls under these restrictions.

To avoid any issues, it is safest to ask your real estate agent in advance whether a property is eligible for foreign ownership.

Many Cambodians Have Distinctive Workplace Characteristics

Cambodians are generally friendly and kind, but from a business standpoint many display characteristics that may feel “loose” by Japanese standards, such as:

- Tardiness: Being about an hour late is not unusual and is often not seen as a serious problem

- Absenteeism: Employees may frequently miss work for various reasons, including repeatedly citing funerals of the same relative

- Job-hopping: Some employees quickly jump to better-paying opportunities, and there are cases where people resign after only a month and repeat this pattern

Of course, there are individual differences, but these tendencies are based on patterns observed by Ms. Araki herself when employing multiple Cambodian staff.

These behaviors can be hard to accept from the perspective of typical Japanese business practices and may lead to friction with Japanese employees.

For Foreign Companies in Cambodia, a Private Limited Liability Company Is Recommended

When establishing a company in Cambodia, foreign companies are generally advised to choose the structure of a private limited liability company.

In a private limited liability company, shares are not publicly traded, and shareholders’ liability is limited to the amount of their capital contribution.

This structure makes it harder for third parties to interfere in management and helps reduce overall risk.

By contrast, a public limited liability company lists its shares on the securities market.

This makes it easier to raise capital but also increases the risk that major shareholders or outside investors may exert significant influence over management decisions.

It Is Common for Foreign Companies to Establish a Local Subsidiary

The most common form of entity chosen by foreign companies in Cambodia is a local subsidiary (a locally incorporated company).

Local subsidiaries can accommodate a wide range of industries and business scales and have the following characteristics:

| Trade name | A unique trade name can be used, but names similar to existing companies may be rejected. |

| Capital | Minimum capital is 1,000 shares with a total of 4,000,000 riel (4,000 riel per share) Equivalent to roughly 1,000 USD |

| Registered address | A Cambodian address must be used for registration |

| Directors | For private limited companies, at least 1 natural person For public limited companies, at least 3 natural persons No restrictions on nationality or place of residence In principle, board meetings must be held at least once every three months |

| Liability | Limited liability (debts are limited to the amount of capital contributed by shareholders) |

| Taxation | Subject to corporate tax, withholding tax, personal income tax, and value-added tax (VAT) |

Here, “natural person” refers to an individual who can hold rights and obligations, as opposed to a corporate entity.

VAT is a tax on goods and services and is similar in nature to Japan’s consumption tax.

Depending on business type and objectives, other options include partnership structures, setting up a branch office, or establishing a representative office.

For more details on company establishment in Cambodia, please refer to our dedicated article.

Approximate Initial Costs for Foreign Companies Establishing a Company in Cambodia

Foreign companies must complete the required procedures with several Cambodian authorities when incorporating a company, and each procedure involves certain fees.

Approximate costs for establishing a company in Cambodia are as follows:

| Cost Item | Amount (USD) | Authority / Institution |

|---|---|---|

| Capital | 1,000 and up | — |

| Trade name reservation | 6.25 | Ministry of Commerce |

| Trade name registration | 252.5 | Ministry of Commerce |

| Taxpayer registration | 100 | General Department of Taxation (GDT) |

| Patent tax registration | 50–375 | General Department of Taxation (GDT) |

| Business location declaration | 30 | Ministry of Labour and Vocational Training |

| Company book registration | 20 | Ministry of Labour and Vocational Training |

| Employee payroll book | 20 | Ministry of Labour and Vocational Training |

| Bank balance certificate | 10 | Bank / General Department of Taxation |

| Total | 1,163.75–1,488.75 |

※Figures above are approximate and may change due to amendments in Cambodian law or international circumstances.

Assuming 1 USD = 150 yen, initial incorporation costs in Cambodia are roughly 170,000–220,000 yen.

In addition to incorporation costs, you should expect to pay rent or purchase prices for office and housing, costs for office furniture and IT equipment, and potentially interior fit-out expenses.

Our firm supports foreign companies entering the Cambodian market. For relatively small-scale businesses, we can assist with office equipment procurement, and introduce lawyers and tax accountants for approximately 3,000–5,000 USD (about 450,000–750,000 yen at 1 USD = 150 yen).

Steps for Foreign Companies to Establish a Company in Cambodia

To set up a company in Cambodia, foreign companies must submit the necessary documents to multiple ministries and agencies.

In addition, they must open bank accounts and register office locations.

Below, we outline the step-by-step process of company establishment in Cambodia.

Decide on a Trade Name to Be Used Locally

Your first step should be to decide on the trade name (company name) that will represent your business in Cambodia.

Because trade names that closely resemble those of existing companies may be rejected, it is wise to search online in advance and prepare multiple candidate names.

You can check whether your preferred trade name is available by submitting an online inquiry to the Ministry of Commerce.

If there are no issues, the name can be reserved.

When applying, you will be asked to provide the following information:

- Business objectives and activities (up to five items)

- Registered address (company address in Cambodia)

- Monthly rent for the office (if leasing)

- Contact information (company email address and phone number)

- Type of shares and capital structure

- Director(s) or representative(s): name, address in Cambodia, email, phone number, and passport details

- Shareholders and registered shareholder representative details

Source: JETRO Phnom Penh Office, “Cambodia Company Establishment Manual, Revised February 2021”

The Ministry of Commerce typically takes around 3–7 business days to respond.

Once reserved, a trade name is valid for about three months.

A name reservation fee of 6.25 USD applies.

Consider Office, Residential, and Other Properties

When establishing a company in Cambodia, it is important to select office and residential properties that will serve as your base of operations.

Because the company registration documents must include a Cambodian address, it is often efficient to secure office and/or residential space early.

If your office location has not yet been decided, you can temporarily stay at a local hotel while searching for properties, or use a virtual office address as a provisional registration address.

Virtual offices are also popular options for sole proprietors and freelancers who do not wish to publicly disclose their home address.

Depending on the scale of your business, using a coworking space can help reduce office-related costs.

However, for operations involving multiple employees, a standard office is usually the most practical and efficient choice.

Prepare the Documents Required for Company Registration

Foreign companies must prepare the following documents when establishing a company in Cambodia:

- Proof of registered address (title deed or lease agreement)

- Articles of association in English (for branches and representative offices, the parent company’s articles)

- Passports or Khmer ID cards for all directors and shareholders

- Recent photographs (4 × 6 cm, taken within the last 3 months, white background) of all directors and shareholders

- Letters of consent to assume directorship or shareholder representation

- Certificate of incorporation (or equivalent) of the corporate parent, in English

- Resolution of the corporate parent to establish the Cambodian entity (often in the form of board meeting minutes)

Source: JETRO Phnom Penh Office, “Cambodia Company Establishment Manual, Revised February 2021”

Because some documents—such as the articles of association—must be drafted in English, language skills and legal knowledge can be a challenge.

As part of our incorporation support services, our firm can introduce lawyers who are proficient in multiple languages.

Obtain the Trade Name from the Ministry of Commerce

Once all required documents are prepared, they are submitted electronically to the Ministry of Commerce.

If there are no issues with the documents, the Ministry will officially approve the trade name.

You will receive a notification by email once approval is granted, and related ministries and agencies will be informed as well.

The typical timeframe from submission to approval is about 2 weeks to 1 month.

A fee of 252.5 USD is charged when the trade name registration is completed.

Register for Tax with the General Department of Taxation (GDT)

After obtaining the trade name from the Ministry of Commerce, you must register for tax with the General Department of Taxation.

At this stage, you will provide the following information and pay a tax registration fee of 100 USD:

- Fiscal year used

- Employee information (expected headcount and total payroll)

- Photo of the business signboard (if already installed)

- Expected sales figures

- Name of the person to be listed on the patent tax registration

- Fixed asset information for the office location

Source: JETRO Phnom Penh Office, “Cambodia Company Establishment Manual, Revised February 2021”

Patent tax (often referred to as the business tax) varies by business size:

- Small-scale business: around 50 USD

- Medium-scale business: around 150 USD

- Large-scale business: around 375 USD

Procedures at the GDT must be completed by the representative in person and include taking a photograph, providing fingerprints, and signing documents.

Importantly, you must complete these procedures within 15 days of receiving the trade name approval, so attention to timing is critical.

Receive the Certificate of Incorporation and Tax Documents

After you complete the tax registration procedures at the GDT, the following documents will be issued:

From the Ministry of Commerce

- Certificate of Incorporation

- Company seal

- Articles of Association

From the General Department of Taxation

- Tax registration certificate

- Tax registration ID card

- Patent tax certificate

- VAT registration certificate

Here, VAT refers to value-added tax, which corresponds to consumption tax in Japan.

Register Your Corporate Bank Account with the GDT

Following tax registration, you must submit a bank balance certificate issued by a Cambodian licensed bank and register your corporate bank account with the GDT.

This must be done within two weeks of tax registration. If you miss this deadline, your tax registration may be invalidated.

Because Cambodian banks allow non-residents to open accounts, it is possible—and often efficient—to open your bank account before traveling to Cambodia.

We offer support both via local account-opening tours and online procedures through inquiries made via our website.

Complete Employment-Related Procedures with the Ministry of Labour and Vocational Training

At the Ministry of Labour and Vocational Training, you must complete procedures related to your business location and employee hiring:

- Business location declaration: Report the opening of the business and hiring of employees

- Company book registration: Register the company book used in labor inspections

- Employee payroll book registration: Register the payroll book for recording employees’ wages

The business location declaration fee is 30 USD, and the company book and payroll book registrations cost 20 USD each.

Although system improvements have increased inter-agency coordination, these two registrations are still handled as separate procedures, so you must apply for both.

Hire Employees as Needed

Once procedures at the Ministry of Labour and Vocational Training are complete, you may begin hiring employees.

Cambodia has a labor law that sets minimum standards, including:

- Working hours: Up to 8 hours per day, 48 hours per week

- Days off: In principle, Sunday (work beyond 6 days per week is not allowed)

- Paid leave: 18 days per year, with 1 additional day every 3 years of service

- Minimum wage: 208 USD per month (for manufacturing and certain sectors, revised in 2025)

- Social insurance: Employer pays the full contribution to the national social security fund based on employee wages

In principle, the ratio of foreign to Cambodian employees should be kept within 1:9, but exceptions may be granted upon application to the Ministry of Labour and Vocational Training.

Foreign employees must also obtain a work permit.

Licenses May Be Required Depending on the Business Type

Depending on the industry, companies in Cambodia may need to obtain specific licenses that require meeting certain conditions.

Examples include:

| Industry | Supervisory Authority | Notes |

|---|---|---|

| Restaurant | Ministry of Tourism | Sanitation certificate; fire safety certificate |

| Hotel / Guest house | Ministry of Tourism | Fire safety certificate required |

| Travel agency | Ministry of Tourism | Security deposit required |

| Real estate services | Ministry of Economy and Finance | Police clearance certificate required |

| Insurance agency / brokerage | Ministry of Economy and Finance | Police clearance certificate required |

| Customs brokerage | General Department of Customs and Excise | Qualified customs specialists needed |

| Logistics / Transportation | Ministry of Public Works and Transport | Trucks must also be registered |

| Clinics and hospitals | Ministry of Health | Representative must be a Cambodian national |

| Overseas trainee dispatch | Ministry of Labour | 51%+ shareholder / representative must be Cambodian; security deposit required |

| Educational institutions | Ministry of Education, Youth and Sport | Subject to screening and approval |

※Partial list.

Source: JETRO Phnom Penh Office, “Cambodia Company Establishment Manual, Revised February 2021”

For example, in the real estate services sector, applicants must prove that they have no criminal record as a condition of obtaining a license.

Operating without the required license may result in penalties, so it is essential to confirm whether your planned business type requires a license and what conditions apply.

The Three Main Types of Office Properties in Cambodia

When searching for office space in Cambodia, you can choose from standard commercial offices, coworking spaces, and virtual offices.

Below, we explain the characteristics of each type in detail.

Commercial Offices and Retail Spaces: The Most Standard Property Type

The most common way to secure offices or retail spaces in Cambodia is through a real estate agent.

Once you lease an office, you have exclusive use of a designated area within the building, making it easy to adapt the space to your own needs.

Property prices in Cambodia are relatively low. A typical office of about 50 m² can be rented for around 100,000–200,000 yen per month.

Coworking Spaces: Suitable for Startups and Small Businesses

Coworking spaces are shared offices, and their numbers have been increasing in Cambodia, especially in Phnom Penh.

In addition to shared workspaces, many facilities offer private rooms, printers, and amenities such as drink stations and cafés.

Because they are fully equipped and generally cheaper than traditional offices, coworking spaces are particularly suitable for sole proprietors, freelancers, and startups with relatively small operations.

Many facilities offer both drop-in (pay-as-you-go) usage and monthly plans; monthly plans typically offer lower effective rates.

However, because equipment and space are shared with other users, overall convenience and privacy may be lower than in a private office.

Virtual Offices: Company Registration Without a Physical Office

Virtual offices exist online rather than as physical spaces.

You can use the virtual office address for company registration, and depending on the service provider, you may also receive a business email address and mail-forwarding services.

Virtual offices are significantly cheaper than real offices, making them a good option if you want to minimize initial costs or simply need an address for registration during the early stages.

They are also popular among sole proprietors who wish to avoid publicly listing their home address.

However, you will need to complete address-change procedures if you move to a physical office later.

And because there is no actual office space, virtual offices are generally unsuitable for teams or operations that require on-site collaboration.

Market Price Ranges for Office Properties in Cambodia by Purpose

When using office space in Cambodia, you can either lease or purchase a property.

You can also use coworking spaces or virtual offices in combination, depending on your budget and business model.

Below, we outline typical price ranges for each option.

Leasing: General Office Spaces at Around 100,000–200,000 Yen per Month

In Phnom Penh, a typical office unit of about 50 m², including office space and a restroom, rents for around 100,000–200,000 yen per month.

Rents vary depending on the building’s age, location, and facilities.

Many offices in Phnom Penh are conveniently located near government offices and shopping malls.

For retail spaces of about 50 m², typical rents are around 150,000–300,000 yen per month.

There are also numerous warehouse properties in Phnom Penh. While rents for these are higher—around 300,000–450,000 yen per month—their floor areas are often very large at 600–1,000 m².

Purchase: Office Units Around Phnom Penh Typically in the 10–20 Million Yen Range

Office units for purchase in Phnom Penh are generally priced in the 10–20 million yen range.

Many properties include air conditioning, toilets, and sometimes shower rooms, and some can also be used as retail spaces.

Large, high-grade office buildings tend to command higher rents or purchase prices, but they offer comprehensive facilities and building systems.

Establishing an office in such a building can significantly improve your company’s brand image.

Coworking Spaces: Monthly Fees Around 10,000 Yen

In and around Phnom Penh, coworking spaces offer both drop-in usage and dedicated-desk rentals.

A typical drop-in rate is about 1,000 yen per day, while monthly plans are often around 10,000 yen.

Many facilities provide private rooms accommodating 5–6 people, as well as cafés and shared lounges.

While coworking spaces are more affordable than standard offices, keep in mind that most facilities and equipment are shared with other users.

Virtual Offices: Standard Services Around 10,000 Yen per Month

Virtual offices in Phnom Penh typically charge around 10,000 yen per month for basic services.

You can use the virtual office address to register your company and may also obtain business email addresses under the provider’s domain.

For additional fees, you can often add services such as telephone answering, mail forwarding, and meeting room usage.

Virtual offices allow you to register a company at significantly lower cost than renting a real office.

However, you must secure separate physical workspace if you need an actual office environment.

Phnom Penh Is the Recommended Location for Office Properties

For foreign companies entering the Cambodian market, we recommend focusing on Phnom Penh for your initial office and residential properties.

The Phnom Penh area has expanded its urban functions along with Cambodia’s economic growth and offers a highly convenient business environment.

Many real estate agents focus primarily on the Phnom Penh area, which means you will generally have a wider selection of properties to choose from.

In rural areas, office properties may be limited or non-existent, and infrastructure and facilities are often less developed than in Phnom Penh.

For these reasons, rural locations are not ideal for first-time market entrants.

5 Recommended Commercial Properties in Phnom Penh

Below are five recommended high-grade properties in Phnom Penh.

All of them are well-equipped, and establishing a presence in these buildings can also enhance your company’s brand image.

Flatiron: Hotel-Attached Offices in the Financial District

Flatiron is a hotel-attached office complex located in Phnom Penh City Center.

This district is comparable to Kasumigaseki in Tokyo, with a high concentration of government offices, banks, and other key institutions.

The 42-story high-rise building houses a hotel, conference rooms, restaurants, a gym, and a kids’ room, among other facilities, catering to a wide variety of business needs.

The property also includes residential units, making it well-suited for arrangements such as living close to the office, accommodating business travelers, or hosting guests.

Exchange Square: Retail-Attached Offices with State-of-the-Art Systems

Exchange Square comprises a 16-story office tower and a 4-story retail podium with a total floor area of about 18,000 m².

It is located in central Phnom Penh, about 45 minutes from Phnom Penh International Airport, providing excellent access.

The office area is equipped with its own power generation system, helping maintain operations during power outages, and boasts robust security systems.

As a landmark-scale property, Exchange Square also offers strong potential to draw customer traffic to retail tenants.

Vattanac Capital Tower: Mixed-Use Office Building and Tourist Landmark

Vattanac Capital Tower is 39 stories tall and 188 meters high, making it a prominent landmark in Phnom Penh and a popular tourist destination.

In addition to office floors, it features a hotel and shopping mall. Its unique exterior design has earned it the nickname “the Penguin” among locals.

The office floors host many Western and Japanese companies, while the mall is home to high-end luxury brands, catering to affluent customers.

The building also offers coworking spaces and inclusive electricity plans, providing a wide range of usage options for different business scenarios.

Sathapana Bank Tower: Bank-Attached Offices with Strong Ties to Japanese Business

Sathapana Bank Tower is a 22-story building with 4 basement levels and is owned by Sathapana Bank, one of Cambodia’s major financial institutions.

The bank’s predecessor was Maruhan Japan Bank, in which a Japanese company was the largest shareholder. In 2016 it merged with a major local financial institution to become Sathapana Bank.

In addition to office floors, the building houses Sathapana’s head office, allowing tenants to handle banking transactions within the same building—a major advantage for cash management.

Developed jointly by the Maruhan Group and companies affiliated with Korea’s Lotte Group, the building has received an international A-grade rating.

Vue Aston: Condo with Co-Working Space, Ideal for Sole Proprietors

Vue Aston is a 38-story luxury condominium with a wide range of on-site facilities.

In addition to residential units, it features a hotel, shared offices, conference rooms, restaurants, and lounges, offering high versatility for different lifestyles and work styles.

It can be used as both a residence and an office, making it a particularly good choice for sole proprietors and freelancers.

Overlooking both the Mekong River and the Bassac River, and with five beautifully landscaped gardens, the property also excels in comfort and livability.

When Entering Cambodia, It’s Best to Open Both Corporate and Personal Bank Accounts

When establishing a company in Cambodia, you must open a corporate account with a licensed Cambodian bank and register it with the GDT.

Corporate bank accounts are essential for business operations, but Cambodian bank accounts also offer many advantages, which is why we strongly recommend opening them:

- Deposits are held in US dollars

- Non-residents can open accounts (and retain them even after moving abroad)

- Average fixed-deposit interest rates of around 4–5% are very high

- No major restrictions on international remittances

- Many banks offer Japanese-language support desks

It is also possible to open bank accounts before moving to Cambodia, which allows you to prepare well in advance.

Our firm has extensive experience supporting Cambodian bank account openings and provides strong after-sales support.

We regularly organize local tours combining property inspections and bank account openings and also support fully online account-opening procedures.

For more details on recommended Cambodian banks, please see our related article.

ANNA ADVISORS Provides Total Support for Corporate Entry into Cambodia

Our firm operates businesses rooted in Cambodia and actively supports companies entering the local market.

We arrange office and residential properties that will serve as the foundation for your business and daily life, and we can also procure office equipment and coordinate interior fit-out work as needed.

We are able to introduce lawyers and tax accountants, helping you navigate language barriers in preparing registration documents and handling accounting entries for incorporation costs.

We also have a strong track record of supporting Cambodian bank account openings and provide comprehensive after-sales support.

In addition to organizing local tours that combine property viewing and bank account opening, we also handle fully online contracts.

Drawing on our own experience as a company incorporated in Cambodia, we provide total coordination for first-time overseas expansion and local startup projects.

Summary

Cambodia is experiencing rapid economic development and is attracting attention as both a destination for foreign corporate expansion and a base for business operations.

Office rental prices in Cambodia are relatively affordable, with typical office leases around 100,000–200,000 yen per month and purchase prices around 10–20 million yen.

Depending on your business scale and financial situation, using coworking spaces or virtual offices can be an effective way to optimize costs.

While the initial costs of incorporating a company in Cambodia are relatively low, some procedures must be completed in person, and certain documents need to be prepared in English, which can place a burden on companies unfamiliar with the process.

At ANNA ADVISORS, we offer comprehensive support for corporate expansion and local startup activities, including office and housing brokerage, procurement of office equipment, and introductions to lawyers and tax accountants.

We also provide full after-sales support for the Cambodian bank accounts your business will need.

If you are considering establishing a company in Cambodia and would like a partner to coordinate the entire process from start to finish, please do not hesitate to contact us.