Can Foreigners Own Land in Cambodia? Understanding Regulations Is Crucial for Cambodian Real Estate Investment

Author: Anna Araki / Anna Advisors Inc.

The Cambodian government is actively encouraging foreign capital and promoting real estate investment by foreigners.

In Japan, there are many companies that handle Cambodian properties, and you may be wondering:

“Can you actually buy land in Cambodia?”

In this article, we explain in detail—based on Cambodian law—what types of real estate Japanese investors can purchase.

By correctly understanding the types of real estate and ownership rights available in Cambodia, you can start your investment journey with a more structured and realistic plan.

https://youtube.com/watch?v=LDGRyrwv2HQ%3Ffeature%3Doembed%26enablejsapi%3D1%26origin%3Dhttps%3A

Table of Contents

- In Principle, Foreigners Cannot Own Land in Cambodia

- How Foreign Corporations Can Use Land Through Local Entities

- Four Types of Real Estate Ownership Titles in Cambodia

- Types of Properties Foreigners Can Purchase in Cambodian Real Estate Investment

- Five Advantages of Cambodian Real Estate Investment for Foreigners

- Three Disadvantages and Risks of Cambodian Real Estate Investment for Foreigners

- Overview of Key Taxes on Cambodian Real Estate Investment

- Choosing a Reliable Intermediary Is the Key to Success in Cambodian Real Estate Investment

- Conclusion

In Principle, Foreigners Cannot Own Land in Cambodia

To begin with the conclusion: foreigners are not allowed to own land in Cambodia.

Article 44 of the Cambodian Constitution states that:

“Only legal entities of Khmer nationality and Khmer citizens shall have the right to own land.”

The 2001 Land Law also specifies that only legal entities conducting business in Cambodia and Cambodian nationalsmay own land in the country.

In other words, the Constitution and relevant laws clearly stipulate that individuals without Cambodian nationality (foreigners) cannot purchase or own land. This is an important point to keep in mind.

Details on land ownership in Cambodia are also available in Japan’s Ministry of Land, Infrastructure, Transport and Tourism’s “Overseas Construction and Real Estate Market Database.”

How Foreign Corporations Can Use Land Through Local Entities

While Cambodian law and the Constitution prohibit land ownership by foreigners, there are exceptions for locally registered corporations.

If certain procedures are followed, foreign-affiliated companies can, under specific structures, hold rights to land.

Broadly speaking, there are three methods by which foreign corporations can gain access to land in Cambodia.

Establishing a Joint Venture With a Cambodian Company

A foreign corporation can establish a joint venture company with a Cambodian company and register it as a “local (domestic) corporation.”

Once registered as a domestic corporation, the entity becomes eligible to own land in Cambodia.

To qualify as a domestic corporation:

The foreign partner(s) must hold 49% or less.

The Cambodian partner(s) must hold at least 51% of the shares.

Leasing Real Estate From Cambodian Individuals and Companies

Another approach is for a foreign corporation to lease real estate from Cambodian nationals or Cambodian companies.

In this case, the foreign corporation holds leasehold rights rather than direct ownership.

Lease arrangements are generally classified into two categories:

- Short-term leasehold: Up to 15 years

- Long-term leasehold: More than 15 years and up to 50 years

For short-term leaseholds, if the lessee wishes to transfer or sublease the property, they must obtain the lessor’s consent.

Long-term leaseholds (often referred to as “perpetual leases” in practice) are more flexible:

- The lessee may transfer, sublease, or use the property as collateral without the lessor’s consent.

- With the proper procedures, long-term leaseholds can be extended up to a maximum of 50 years.

Generally:

Long-term leaseholds are often used for larger properties such as logistics centers and factories.

Short-term leaseholds are used for smaller properties such as offices and shops.

Acquiring a Land Concession

Foreign companies can also use land through land concessions granted by the Cambodian government.

- A land concession can cover up to 10,000 hectares.

- The initial concession period is up to 99 years.

Land concessions fall into three main types:

- Social Concessions

- Granted when the land is used for residential construction or subsistence farming.

- Foreign corporations are not eligible for social concessions.

- Economic Concessions

- Intended to promote economic activities.

- Allow land use for plantations, agricultural facilities, tourism facilities, and other commercial purposes.

- Widely used by foreign corporations.

- Use, Development, and Exploration Concessions

- Applicable to projects involving infrastructure such as electricity, water, gas, and housing supply.

Once a concession is granted, the holder has exclusive rights to use the land.

However, the government retains the right to terminate the concession if deemed necessary, which is an important risk to bear in mind.

Four Types of Real Estate Ownership Titles in Cambodia

When purchasing real estate in Cambodia, the existence and type of ownership title (“title deed”) is extremely important.

To prevent disputes, investors should always ensure that an appropriate title is obtained.

There are four main types of titles used in Cambodian real estate transactions:

・Strata Title

・Hard Title

・Soft Title

・LMAP Title

Hard Title | Government-Registered Ownership With Strong Legal Force

A Hard Title is the most powerful ownership document that can be issued in Cambodia and roughly corresponds to a property title deed in Japan.

- It is based on a government-led registration process.

- Land is measured using tools such as aerial photographs, and boundary lines are officially defined.

Even if a Soft Title exists for the same property, the Hard Title takes precedence, giving it strong authority in ownership disputes.

Hard Titles are valid nationwide, but at present foreigners cannot directly obtain Hard Titles.

For foreign buyers, the key title is the Strata Title, discussed below.

Soft Title | Weaker Legal Force Than Hard Titles

A Soft Title is issued under the name of the head of the local commune or sangkat (sub-district), and its legal force is more limited than that of a Hard Title.

- Its validity is essentially confined to the local administrative level.

- It primarily proves that a transaction took place, rather than guaranteeing ownership in the strong legal sense.

Because Soft Titles provide weaker legal protection, they may not be sufficient to resolve serious ownership disputes.

Japan’s Ministry of Land, Infrastructure, Transport and Tourism explains Soft Titles in its “Overseas Construction and Real Estate Market Database” as:

“Documents that can be issued relatively easily by paying a fee to the local municipal office.”

At present, foreigners are not allowed to obtain Soft Titles.

Moreover, because they provide limited protection in ownership disputes, there is a trend toward converting Soft Titles into Hard Titles.

LMAP Title | Hard Title Enhanced With New Technology

The LMAP Title was introduced in 2002, and the name comes from the initials of Land Management and Administration Project.

LMAP Titles:

- Incorporate GPS-based surveying, which Hard Titles do not, allowing for more precise boundary definitions.

- Are highly effective in preventing land disputes, and because they also possess the characteristics of Hard Titles, they are currently considered the strongest form of title.

Only Cambodian nationals can obtain LMAP Titles, and issuance requires that the property be registered in the cadastral (land) map.

Strata Title | Widely Available to Foreigners and Increasing in Number

The Strata Title, introduced in 2009, corresponds to sectional ownership rights in a building (similar to condominium unit ownership in Japan).

- It is currently the only type of title that foreigners can obtain.

- Like Hard Titles, it is valid nationwide.

- It applies not only to land but also to buildings such as condominiums.

Because it allows foreigners to own properties more safely, the number of Strata Titles issued has been increasing in recent years.

In Cambodian real estate investment, it is crucial for foreigners to obtain a Strata Title when purchasing a property, in order to avoid ownership disputes.

However, as we will see later, there are restrictions on the types of properties for which Strata Titles can be issued.

Types of Properties Foreigners Can Purchase in Cambodian Real Estate Investment

Although foreigners generally cannot own land in Cambodia, they can purchase buildings in a relatively wide range of cases.

However, there are important regulations on building purchases as well.

Below is an overview of the types of buildings foreigners can buy and the key purchase conditions.

Residential Properties Such as Apartments and Condominiums

When people think of real estate investment, many imagine buying one unit in an apartment or condominium and renting it out.

This model is certainly feasible in Cambodia.

- The country’s rapid economic growth has led to an increase in high-grade properties, especially in Phnom Penh.

- Around Phnom Penh, there are many properties whose quality rivals that of central Tokyo.

- Demand is rising among overseas high-net-worth individuals and domestic high-income earners.

In particular, many condominiums in Cambodia:

Come with attractive features such as rooftop swimming pools and other amenities.

Resemble Japanese high-rise tower mansions, and

Commercial Properties Such as Hotels and Offices

Foreigners are also allowed to purchase commercial properties, such as hotels and office buildings.

Compared with individual tenants, corporate tenants generally pose lower risks of vacancy and rent arrears, which can make it easier to manage such investments stably.

Cambodia has many world-famous tourist attractions such as Angkor Wat, and there are numerous high-end and resort hotels in urban centers like Phnom Penh.

In addition, many foreign companies are looking to Cambodia as a promising emerging market, and office demand is rising as more businesses establish a presence.

Important Restrictions on Property Purchases by Foreigners

Cambodia imposes several important restrictions on what and how foreigners can purchase.

Key conditions include:

- Foreigners may only purchase above the second floor of a building. Basement and ground floors cannot be purchased.

- Foreign ownership is limited to 70% of the total floor area of a building (this is the combined total of all foreign individuals and foreign companies).

- Foreigners can only purchase buildings constructed in 2010 or later.

- Foreigners cannot purchase properties located within 30 km of the national border.

These conditions are linked to the acquisition of Strata Titles.

If you are not fully aware of these rules, you may find that you cannot purchase your target property, which can disrupt your investment plan. It is therefore essential to understand these restrictions in advance.

Five Advantages of Cambodian Real Estate Investment for Foreigners

The Cambodian government actively encourages foreign investment, and foreigners enjoy several advantages when investing in real estate.

Below we summarize five major benefits of Cambodian real estate investment for foreign investors.

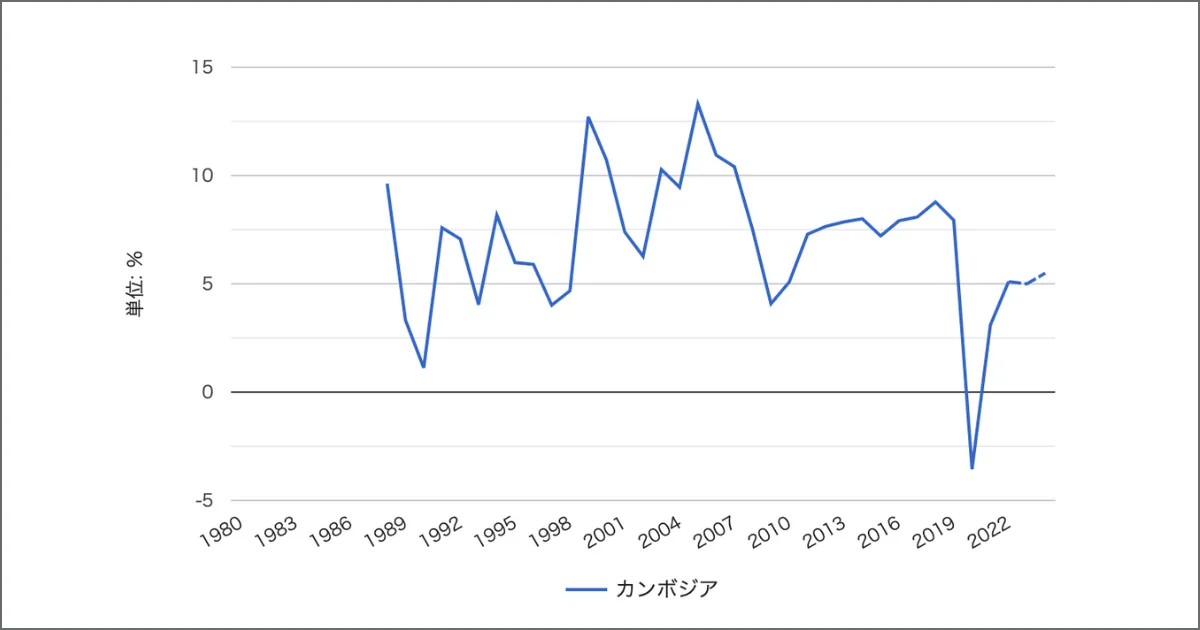

GDP成長率の上昇に伴って土地価格が上昇

Rising Land Prices in Line With GDP Growth

Cambodia has been experiencing strong GDP growth, and land prices have risen in step with this economic expansion.

(Here, in the original Japanese article, a chart showing the trend in Cambodia’s GDP growth rate is inserted.)

The sharp decline around 2020 is attributable to the COVID-19 pandemic, but growth has since resumed.

In 2024, the GDP growth rate was 5.49% year-on-year.

Alongside rising land prices, average incomes are also increasing, and domestic high-net-worth individuals are showing expanding demand for high-grade properties.。

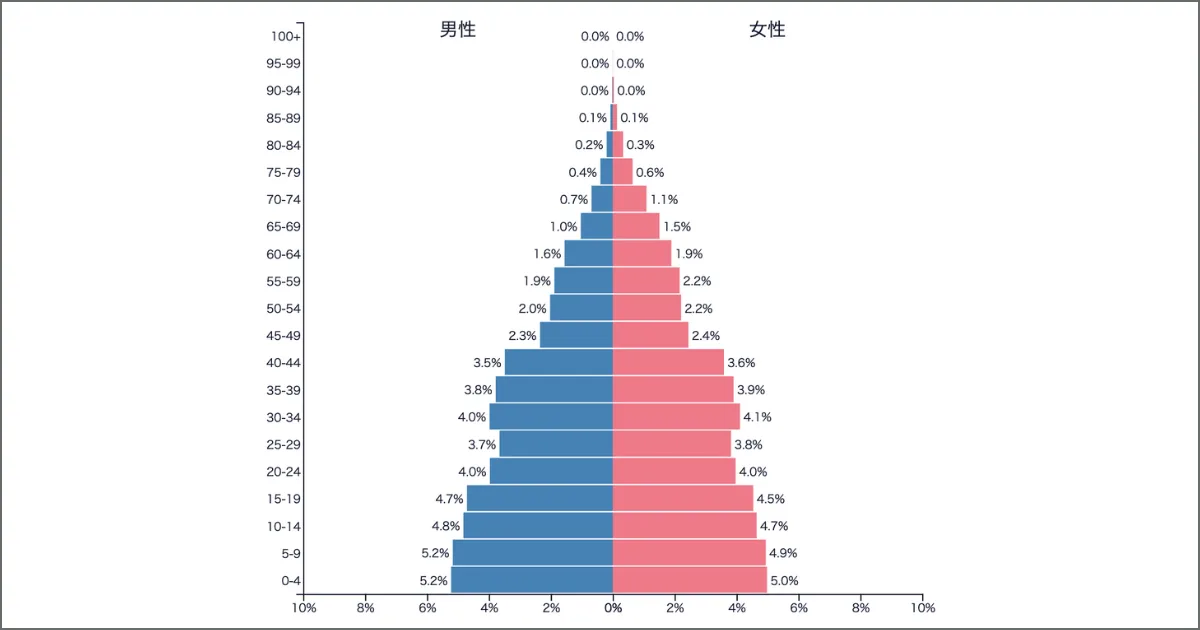

Young Population and Strong Long-Term Growth Potential

Cambodia’s population structure is characterized by a large share of the working-age population (ages 15–64) and a particularly high proportion of young people.

(Here, the original article refers to a population pyramid chart.)

With a large and relatively young workforce, Cambodia has strong long-term growth potential, and this demographic advantage is expected to continue driving its economy.

In contrast, Japan faces a shrinking population and accelerating aging, which highlights the structural differences between the two countries.

Ability to Hold Real Estate Income in US Dollars

In most parts of Cambodia, the US dollar circulates widely and functions as the de facto key currency.

- Real estate transactions are typically conducted in USD.

- Investors can hold their real estate income and assets in US dollars.

Given recent volatility and depreciation pressures on the Japanese yen, the ability to diversify assets between JPY and USD helps mitigate foreign exchange risk.

Furthermore:

- Average interest rates on fixed deposits in Cambodia are around 4–5%, which is relatively high.

- Even non-residents can open bank accounts.

By operating Cambodian real estate at high yields and depositing the returns into high-interest Cambodian bank accounts, investors can pursue more efficient asset management.

(For more details on Cambodian banks, see our separate article dedicated to that topic.)

Increasing Number of Properties, Especially in Phnom Penh

Supported by strong economic growth, Cambodia has made steady progress in development, particularly with urban expansion centered on Phnom Penh.

- Phnom Penh’s growth has been remarkable, and the scale of the city can be compared favorably to Tokyo in some respects.

- Two major rivers—the Mekong River and the Tonle Sap River—flow through the city.

Riverside areas are:

- Popular as view spots, where sightseeing cruises operate, and

- Home to many luxury hotels, condominiums, and commercial facilities.

Phnom Penh is rich in tourism resources (including proximity to Angkor Wat) and serves as a hub for tourism, business, and residential life, making it especially attractive to high-income individuals.

The city is seeing growth in both residential properties (condominiums) and commercial properties (hotels, offices), drawing strong interest from overseas real estate investors.

(For more information on recommended areas for Cambodian real estate investment, please refer to our dedicated article on investment locations.)

Lower Property Prices Compared to Other Southeast Asian Countries

Although Cambodian property prices have been trending upward, overall cost of living and real estate prices remain lower than in many neighboring countries.

For example, 1LDK resale condominiums in the following cities show approximate prices as:

- Phnom Penh: Around JPY 12.5 million (completed in 2023)

- Bangkok: Around JPY 45.8 million (completed in 2019)

- Tokyo (Shinjuku Ward): Around JPY 71 million (completed in 2023)

Cambodia is one of the cheapest countries in Asia in terms of rental levels, and resale units can be purchased starting in the 10-million-yen range.

Because:

- Property prices are relatively low, and

- High occupancy rates can generate substantial rental income,

it is not uncommon to find properties around Phnom Penh offering gross yields of roughly 10%.

Initial investment costs are relatively low, making it easier to start real estate investment and to utilize Cambodian properties as part of a diversified investment portfolio.

Three Disadvantages and Risks of Cambodian Real Estate Investment for Foreigners

Of course, Cambodian real estate investment also entails risks and disadvantages.

Below we highlight three major categories of risk.

Risk of Non-Completion of Pre-Built Properties

As mentioned earlier, pre-build schemes are widely used in Cambodian development projects.

Under this structure:

- Buyers pay a small deposit at project commencement, and

- Pay the remaining balance in stages as construction progresses.

If the developer goes bankrupt or faces serious financial difficulties, construction may be suspended, and the property may never be completed.

Even without bankruptcy, it is not uncommon for projects to experience significant delays.

In many cases:

- There is no refund of funds already committed if the project does not reach completion.

- Investors may therefore face the risk of their capital turning into a sunk cost.

This is one of the most prominent risks of Cambodian real estate investment, and investors must select developers with great care.

Risk of Encountering Unscrupulous Operators and Fraud

Unfortunately, Cambodia has seen a notable number of fraud cases targeting foreign real estate investors.

- Foreigners tend to be less familiar with local conditions and have difficulty monitoring activities on the ground.

- This makes them attractive targets for dishonest operators.

Japanese investors in particular often have much higher income levels than the local average, which can make them appealing targets.

In some cases, even Japanese intermediaries exploit a sense of trust—“we’re all Japanese”—to carry out fraudulent schemes.

Thus, one cannot simply assume safety just because the counterparty is from the same country.

Across all overseas real estate markets, including Cambodia, the quality of the intermediary is absolutely critical.

(Our separate article on Cambodian real estate provides more detailed case studies of fraud and how to avoid them.)

Drawback of an Incomplete Legal System and Potential Rule Changes

Compared with developed countries, the Cambodian real estate market remains immature, and the legal system is not yet fully developed.

The legal framework is fluid and subject to change. For example:

- At present, capital gains from real estate sales by individuals are effectively tax-exempt.

- However, from December 31, 2025, a 20% capital gains tax is scheduled to be introduced for individuals.

That said, the introduction of capital gains tax on individuals has been considered and postponed multiple times, so the outlook remains uncertain.

Because future legal changes may affect the structure of real estate investment, it is important to keep an eye on legal developments when investing in Cambodian properties.

Overview of Key Taxes on Cambodian Real Estate Investment

Foreign investors are also subject to taxation when investing in Cambodian real estate.

The main taxes and related costs include:

| Tax / Cost | Timing | Rate / Description |

|---|---|---|

| Property Transfer Tax | At the time of purchase | 4% of the higher of purchase price or assessed value |

| Stamp Duty | At the time of purchase | 100–2,000 riel (approx. JPY 4–80 at 1 riel = JPY 0.04) |

| Rental Management Fee | Monthly | Fee paid to the management company, typically around USD 100 per month |

| Building Management Fee | Monthly | Maintenance and repair reserve, typically around USD 100 per month |

| Withholding Tax | Monthly | 10% of rental income for residents, 14% for non-residents |

| Tax on Rental Income | Monthly or annually | 10% of gross rent for investment rental income |

| Property Tax | Annually | Applies to properties above USD 25,000; 0.1% of 80% of the assessed property value |

| Capital Gains Tax | At the time of sale | 20% of gains; as of 2024, individuals are effectively exempt, but tax is scheduled for individuals from Dec 31, 2025 |

Non-residents generally face higher effective tax rates than residents, so planning is essential.

As noted, the implementation of capital gains tax on individuals remains uncertain and could be postponed again.

Choosing a Reliable Intermediary Is the Key to Success in Cambodian Real Estate Investment

Cambodian real estate investment offers attractive features:

- Relatively low property prices

- High potential yields

However:

- Purchases are subject to strict conditions, and properties that fall outside these rules cannot be acquired.

- The legal framework is still developing and can be fluid, and investors must be alert to fraud risks.

- Various taxes apply, and without proper structuring and management, it may be difficult to achieve the returns initially expected.

Given that local conditions differ greatly from those in Japan, reliable professional support is essential, especially for first-time investors.

Since our founding, we at Anna Advisors have brokered numerous rental and sale transactions in Cambodia.

- Our representative, Araki, has lived in Cambodia and has personal experience in building assets through Cambodian real estate investment.

- Our team members have deep knowledge of local conditions and are confident in their ability to support clients’ asset building from an investor’s perspective.

We maintain an office in Phnom Penh, where:

- We handle day-to-day management operations, and

- Are able to respond on-site in case of emergencies.

We also actively host seminars in Japan and property tours in Cambodia related to Cambodian real estate investment.

We invite you to join us and explore the opportunities Cambodia has to offer.

Conclusion

Although foreigners cannot directly own land in Cambodia, local corporate structures and specific procedures can allow land use under certain conditions.

For individual investors, the typical strategy is to focus on sectional ownership of buildings.

When purchasing properties in Cambodia, we strongly recommend obtaining a Strata Title to clearly establish ownership and prevent disputes.

For first-time investors, the incomplete legal framework and complex rules regarding ownership and taxation can be daunting.

To succeed in Cambodian real estate investment, the support of a trusted local intermediary is crucial.

Our company has extensive experience in brokering Cambodian properties and supporting investors on the ground.

If you are considering Cambodian real estate investment, we would be delighted to assist you—please feel free to contact us.